The Progressive Federal Income Tax System Explained

Understanding Progressive Tax System, Marginal Tax Rate, Average Tax Rate, and Effective Tax Rate

In America we have a Progressive Federal Income Tax system broken down into “tax brackets.” Tax Filers pay the “marginal tax rate” on each dollar of income in a given bracket (after most deductions, but before tax credits).[1][2][3][4]

By calculating what you owe in each bracket you can find your average rate. When all is said and done, the rate you pay after deductions and credits is your effective tax rate.

This shifts the tax burden onto those with a higher ability to pay and incentivizes people to take deductions, but doesn’t punish people for taking credits.

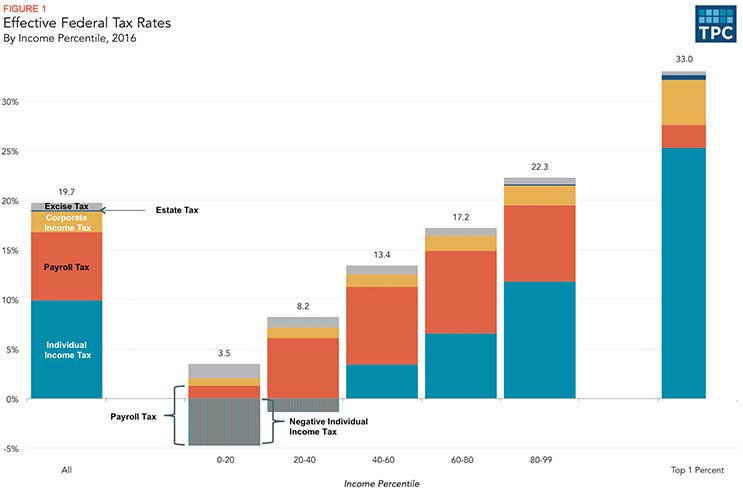

TIP: There are many different types of state and federal taxes, some are fairly flat, some are regressive, and some burden the lowest incomes the most. However, the net effect of federal taxes is a progressive structure as can be seen in the right-hand column of the graphic below. When we add in all state and federal taxes and the cost of living, we can a better picture which shows how the wealth gap grows and why our poorest struggle with costs. The very progressive income tax offsets other cost burdens faced by the majority of Americans.

Effective Federal Tax Rates, for all tax units, by Expanded Cash Income Percentile, Adjusted for Family Size, 2016. Source.

TIP: Most Americans pay little to no federal income taxes, about half of tax filers have a negative effective federal income tax rate!… although as you can see in the chart above, they end up paying other taxes and are faced with other costs. The grand result is the poorest spend more and the rich save more.

Tax brackets and progressive taxation | Taxes | Finance & Capital Markets | Khan AcademyDefinitions

The above is the gist, here are some simple definitions to clarify things.

- A Progressive tax system means that higher incomes are taxed at higher rates, this doesn’t mean you pay the top tax rate on all your dollars. It means you pay an effective tax rate based on your average marginal tax rate after deductions, as explained in the next bullet points.

- Your Marginal Federal Income Tax Rate is the percentage of tax applied to your cash income after deductions for each tax bracket for which you qualify. Ex. My marginal tax rate on my family’s first $18,550 is 10%, my marginal tax rate on my next $18,000 is 15%, I didn’t break the $75,300 threshold, so I don’t owe the 25% tax rate on any cash I’m claiming.

- Likewise, your Average Federal Income Tax Rate is the average rate you pay given your total income. You can find this by calculating the tax owed in each bracket and “averaging” them together. Ex. Our family makes $37,102 (two times $18,550) so our average rate is 12.5% (the average between 10% and 15%).

- Lastly, your actual “Effective” Federal Income Tax Rate is what you pay in practice after deductions and tax credits. Ex. Our family made $40,000, and because of the standard deduction and child care tax credit we got money back this year! Thanks, effective tax rate.

As you can see in the table below, which has rough but not exact percentages for the effective tax rate, the average marginal tax rate and the effective tax rate after tax credits and deductions are two wildly different animals.

TIP: The chart below shows actual tax brackets for 2016 (used for taxes due April 17, 2017) in the first column and them compares it to estimated effective tax rates adjusted for family size. Thus the second column is meant to provide an example for educational purposes. It should not be used for tax filing.

| Marginal Federal Income Tax rate 2016 | Effective Federal Income Tax Rate Adjusted For Family Size

(% of cash income actually paid in federal taxes) |

Married filing jointly

Cash Income After Deductions |

|---|---|---|

| 10% | -11% to -7.1% | Up to $18,550 |

| 15% | -5.4% to 3.8% | $18,551 to $75,300 |

| 25% | 6% to 8% | $75,301 to $151,900 |

| 28% | 8% to 10% | $151,901 to $231,450 |

| 33% | 15% | $231,451 to $413,350 |

| 35% | 15% | $413,351 to $466,950 |

| 39.6% | 22% to 27% | Over $466,951 |

TIP: Effective tax rates are estimates from JCT data as cited by Fool.com and can be referenced against the 2016 projections by the Tax Policy Center featured above. See also, Taxes in the United States: History, Fairness, and Current Political Issues.

The Progressive Federal Tax System

In the table below (from BankRate.com), we can see that an individual who makes over $9,275 pays a marginal tax rate of 10% on the first $9,275, a marginal tax rate of 15% on income between $9,275 – $37,650, then 25% on $37,651 – $91,150, 28% on $91,151 – $190,150, etc.[5][6]

This means that if I make $425,050 after deductions, then only $10,000 of my total income is taxed at the full 39.6%, the next chunk is taxed at 35%, then 33%, all the way down. I can then calculate my “average rate” based on this. This works a little differently for corporate income tax and capital gains tax but the logic is the same.

The table below shows the marginal tax rates that create our progressive federal income tax system and from which average tax rates can be calculated. Finally, the tax rate you owe after all is said and done is “your effective tax rate.”

TIP: The chart below shows actual tax brackets for 2016 (used for taxes due April 17, 2017).

2016 tax brackets (for taxes due April 17, 2017) |

||||

|---|---|---|---|---|

| Tax rate | Single filers | Married filing jointly or qualifying widow/widower | Married filing separately | Head of household |

| 10% | Up to $9,275 | Up to $18,550 | Up to $9,275 | Up to $13,250 |

| 15% | $9,276 to $37,650 | $18,551 to $75,300 | $9,276 to $37,650 | $13,251 to $50,400 |

| 25% | $37,651 to $91,150 | $75,301 to $151,900 | $37,651 to $75,950 | $50,401 to $130,150 |

| 28% | $91,151 to $190,150 | $151,901 to $231,450 | $75,951 to $115,725 | $130,151 to $210,800 |

| 33% | $190,151 to $413,350 | $231,451 to $413,350 | $115,726 to $206,675 | $210,801 to $413,350 |

| 35% | $413,351 to $415,050 | $413,351 to $466,950 | $206,676 to $233,475 | $413,351 to $441,000 |

| 39.6% | $415,051 or more | $466,951 or more | $233,476 or more | $441,001 or more |

If this all seems confusing, please see the video below.

Average and Marginal Tax Rates.

Bonny

60,000/7,5000=8

Where did you get 10% from???

Thomas DeMicheleThe Author

I don’t know exactly what you are referring to? If I made an error I’m happy to correct it, but I am pretty sure everything I wrote above uses real data I’ve cited and that isn’t wrong and I don’t recall writing the numbers you are mentioning above.

Clarify your comment and I’m happy to address it. Thanks in advance 🙂