The Welfare Traps, Tax Traps, and Debt Traps

How a Number of Traps Inhibit Class Mobility

There are a number of traps created from both taxation and assistance that inhibit class mobility. We might generally call these welfare traps, tax traps, and debt traps.[1]

NOTE: The terms welfare trap and poverty trap are common phrases (see citations), the rest are my names for related problems in society. In other words, this page is discussing social and economic theory and offering opinions and insight from a philosophical perspective.

NOTE: These are all examples of good ideas with unintended negative consequences. The problems are often due to the specific way policies are structured in a society (assistance programs aren’t inherently bad, in fact they might be inherently good, but on the same note the side effect of creating a trap when structured a certain way is inherently not good). Also, below I’m generally talking about American society (although specifics aside the concepts are logically universal).

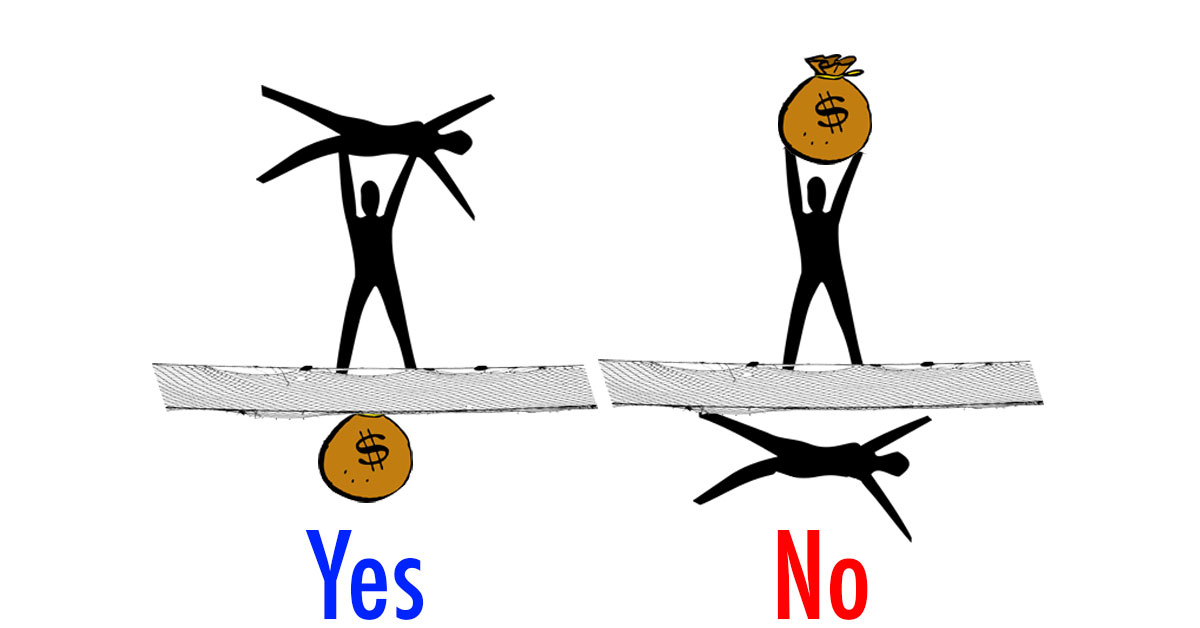

- The welfare trap is very generally a trap in which the benefits of social safety net programs exceed that which can be obtained by getting off welfare by earning more income. This results in a sizable income gap that needs to be crossed for a person or family on welfare to actually benefit from increasing their taxable income. This impacts those with lower incomes and disincentives working or working more. It creates both an unemployment trap and poverty trap (i.e. it traps people in unemployment and poverty).

- The tax trap is very generally a trap in which taxation suppresses the ability of the middle class to move out of the middle class. Consider the small business who has a great year. They are immediately taxed at a higher rate on their newfound profits. This impedes their ability to grow their business in future years when business may be slow or to account for past years when business was slower due to taxation happening within a calendar year. A business could have to close its doors and fire employees in 2018 even if they had a great 2016 if say 2015 and 2017 were slow. This not only suppresses the middle class, but can indirectly impact lower income workers and fellow citizens of the middle and lower classes (less velocity of money in the town, less jobs in the town, less money for higher earning family members to help out their family, less money in the community, everyone gets stuck working at Walmart, etc).

- The debt trap is very generally a trap in which private or public debt extended and interest on that debt impedes the ability of a person to grow their wealth. This can affect the lower and middle classes ensuring that they always owe an increasing sum that may even outpace their ability to earn (especially with the welfare and tax traps in mind; consider, debt must be paid off with aftertax dollars, and to earn those dollars counts toward taxable income).

- The subsidy trap is not the welfare trap, it is instead very generally a trap created as government funds assistance. As government funds assistance it can create an economic bubble (ex. housing bubble, student loan bubble, current healthcare bubble, etc) in the related market. That bubble then requires more funding over time, which then must either result in less assistance offered or greater taxation and/or debt.

- The wealth trap is very generally a “trap” in which the wealthy remain wealthy due to the way capital compounds as avenues for influencing policy, exploiting labor and capital, and exploiting tax loopholes open up as wealth compounds. A capital loss is never a burden, dealing with increased income in a year is a matter of shuffling around money, assistance almost never creates a trap (reliance on tax provisions like cuts and government subsidies for businesses are real issues), etc. This “trap” impacts the wealthy.

NOTE: The common thread here is a trap created from government created a rule-sets for money that have unintended negative consequences (for example with welfare) and/or the a lack of rule-sets for money where they are needed (for example with wealth consolidation and the lack of an effective tax on real wealth, no plebeian “wealth”). “Oddly,” all these traps generally favor the wealthy and suppress the poor and middle class over time despite the fact that welfare, taxes, debt, and subsidies do a lot to benefit those classes in the moment.

NOTE: When I say “oddly” in the above paragraph, I’m being snarky and referring to how capital compounds, how capital is used to influence government, and thus government ends up favoring the wealthy over time. See special interests, the historic impact of wealth inequality, and Capital in the 21st Century.

These Traps and the Income and Wealth Gaps

These traps, when paired with the growing income gap and the much more significant growing wealth gap, help to exacerbate the wealth gap over time keeping the poor poor, the middle class middle class, and the rich rich and all classes increasingly separated (which is a recipe for discord).

In words, these traps inhibit class mobility (to the benefit of the wealthy, but to the detriment of the poor and middle class) and that in turn impact wealth inequality, which has a deteriorating effect on society. To make matters worse this whole system compounds itself over time, resulting in each part of the problem becoming more problematic.

The ironic part of course is, taxation on the middle class largely funds the assistance programs, meaning the lower and middle class end up being each other’s grave digger of sorts.

The downward pressure of all that demands those people to incur debt. The debt is owned by the wealthy and this only adds to the problem.

NOTE: The wealthy pay the most, but not the highest proportion of the expendable income. Likewise, the wealthy might have the most debt, but they also have more expendable income (the poor are trapped under debt, the wealthy tend to be able to leverage debt and avoid un-payable interest). Simply put, wealthier citizens have a greater ability to pay costs related to debt and taxes and are more likely to have excess capital after expenses. The chart below shows that the richest pay the most in taxes, that isn’t being argued. The point above is that the wealthy top % are the only class who, after debt and taxes are considered, ends up with substantial savings… and this compounds over time (as they increasingly not only control the capital but also own the increasing interest on the debt).

This is what is actually happening with Federal Taxes. Source: Tax Policy Center Table T16-0092 and Table T16-0077

Solutions and the Bottomline

Solutions: Accepting that eliminating welfare, taxes, and debt aren’t practical solutions, solutions might include: A greater flexibility for the middle class to pay income and capital gains taxes over the course years and instead of each year (for example the ability to pay tax in a 5 year chunk as a small business on taxable income under $5 million in that period). A life-time based exemption for income (no one owes income taxes on their first million for example). An exemption that allows you to keep welfare after increasing earnings during a transition period. A universal income instead of welfare (so there would never be a need to phase off welfare and additional income only meant additional income; albeit taxable income). A universal estate tax instead of income taxes (tax the wealth of dead, not the income of the living).

Bottomline: These nets which are supposed to catch people when they fall in practice seem to trap the struggling masses under them while the wealth gap grows. That is potentially going to result in things like recessions, depressions, uprisings, etc if history is any guide. So some common sense solutions that diffuse the issue before it becomes even worse are likely in order…. in my opinion.

- Welfare trap. Wikipedia.org.