How and Why Does the Fed Raise Rates, and What Does it Mean?

Understanding the Federal Reserve in Terms of Interest Rates

The Federal Reserve (Fed) has the power to adjust the interest rates that banks charge each other. This impacts rates charged to consumers and businesses. The Fed adjusts rates as a tool to ensure economic stability in the US.[1][2][3]

The base rate that the Fed adjusts is a small range of rates called “the Federal Fund Rate.” Below we explain the Federal fund rate, the other rates it impacts, how adjusting this interest rate affects the broader economy, and why the Fed adjusts rates.

TIP: Economic stability = maximum employment, stable inflation, normal long-term interest rates, etc (see below for the long version).

What Does it Mean that the Fed Sets Rates?

The Fed sets rets like this:

- The Fed sets the Federal fund rate, a small range of rates at which depository institutions (banks and credit unions) lend reserve balances to other depository institutions overnight.

- This affects the Prime rate, which is 1. the rate at which depository institutions will lend money to their favored customers, and 2. a benchmark rate for things like mortgages and credit-card rates. The prime rate is generally a few points above the federal fund rate.

- This then affects what banks will charge consumers and businesses in practice for loans, mortgages, credit, interest rates in savings accounts, etc (where businesses and people pay a premium based on their credit rating).

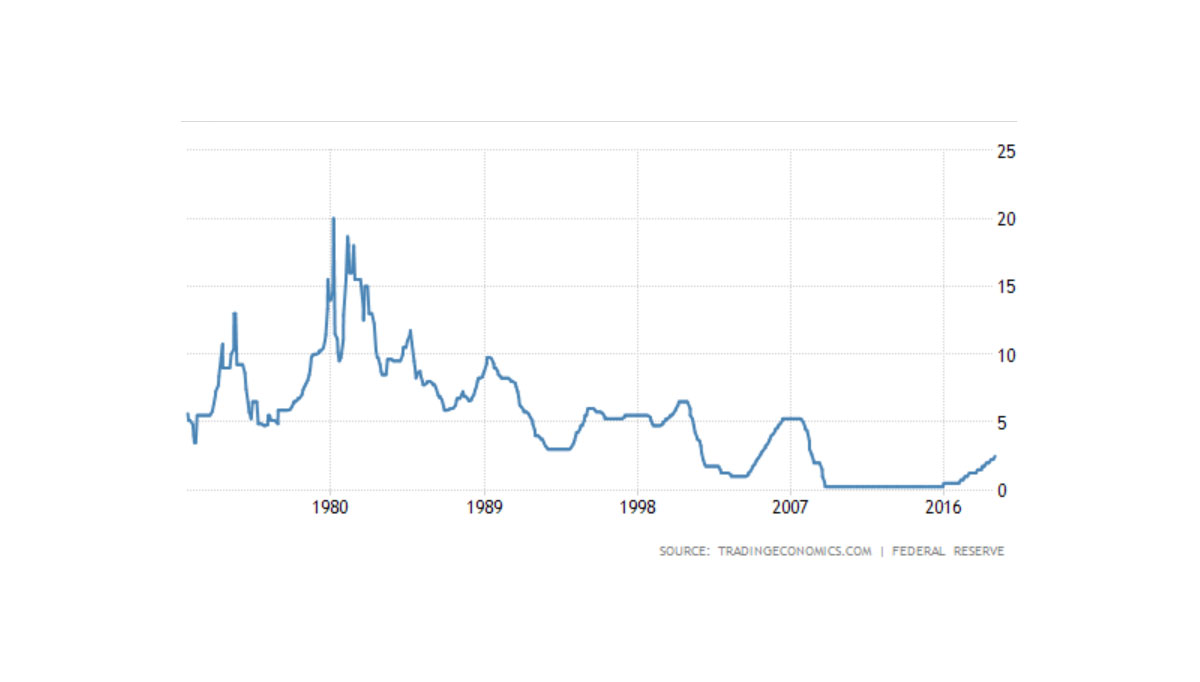

TIP: See a chart showing the federal fund rate over time.

More on the Federal Fund Rate

TIP: You can skip this section and move onto “why does the Fed adjust rates” if you don’t feel like going into nitty gritty details.

The main mechanic at play here is the federal fund rate.

The federal Fund rate is set by the Federal Reserve and then is supported by the Federal Reserve lending banks reserves at a set interest rate, which in turn affects what rate banks will lend to each other at, which in turn affects the benchmark prime rate, which in turn affects the rates businesses and consumers pay.

Fractional Reserve Banking

The reason banks need to borrow from the Fed and lend to each other is that all banks need a certain percentage of reserves to be able to lend bank credit. Thus, banks are constantly moving reserves around to meet this requirement.

That is, banks are lending excess reserves between each other and borrowing to meet requirements between each other and the Fed (see fractional reserve lending).

What are Reserve Notes and Reserve Deposits: Bank credit (credit created from fractional reserve lending) aside, reserves are essentially what we think of as money. There are two versions of reserves. One is a federal reserve note, like a dollar (this can come in a paper form or digital form). The other is a federal reserve deposit (this represents assets like treasury bonds and gold held by the federal reserve in deposit). Federal deposits held by private banks can be converted into notes by private banks to meet customer demand and vice versa. Private banks need to hold federal reserves in order to lend. They can hold reserve notes, or they can hold reserve deposits.

Repos, Floors, Ceilings, and the Federal Fund Rate

To ensure banks adhere to the federal fund rate, the Fed essentially pays banks the federal reserve rate to hold reserves.

That might sound crazy at first, but when you think it out, it makes sense.

It works like this:

- The Fed sells banks reserve deposits (for example treasury bonds the reserve bought from the Treasury) for a day, then buys them back the next day, paying the cost plus the federal reserve rate back. This is called an Overnight Reverse Repurchase Agreement (ON RRP or repo rate). This creates a rate floor.

- The Fed pays banks a little extra for excess reserves it holds onto. This creates a rate ceiling.

This creates an effective range, a floor and ceiling, at which banks are willing to lend to each other and borrow from each other (i.e. a bank wouldn’t lend or borrow at a worse rate than they could get from the Fed… thus the Fed “controls interest rates” via this mechanism).

This also creates an incentive for banks to hold excess reserves when rates are higher, since they may benefit more by holding federal reserves (treasuries and reserve notes) in deposit at the current rate than they would taking the risk lending the money.

Federal Discount Rate: If a bank has to borrow directly from the Fed to meet requirements, they pay a slightly higher rate called a Federal Discount rate. This rate also increases with the Federal fund rate. Generally banks will borrow from other banks rather than pay this rate.

The Federal Fund Rate is a range: As noted above, the federal fund rate is actually a range. In Dec 2018 the rate was raised to 2.25% (floor) to 2.5% (ceiling). In turn, the federal discount rate was raised to 3% and the prime rate was raised to 5.50%. See bankrate.com for more info on current rates.

TIP: Reserves are lent to banks by the Fed on an uncollateralized basis (meaning they lend without taking anything as collateral).

NOTE: Reverse repurchases are a new and temporary mechanism meant to ensure the federal fund rate is followed. They are partly an effect of the Fed purchasing a lot of treasury notes after the 2008 financial crisis.

Why Does the Fed Adjust Rates?

In general rates go down to inspire growth when the economy is showing weakness, and rates go up to pump the breaks when the economy is showing strength.

- Low rates: Cheap credit and low interest paid for holding cash which incentivize risk taking and lending.

- High rates: Expensive credit and high interest paid for holding cash which incentivizes risk-off behavior.

The idea is to promote maximum employment, stable prices, stable markets, stable growth, stable inflation, etc… all while maintaining moderate long-term interest rates on average.

In words, they adjust rates in the short term (months and years), to pump the gas or the breaks on the economy (by affecting the risk behavior of banks, businesses, and people), in order to promote 1. a healthy jobs market, 2. a steady increase in economic growth, and 3. steady inflation over time.

So, if for example congress passes deep tax cuts on businesses and interest rates are very low, and this causes an economic boom, the Fed might raise rates to pump the breaks on the economy to stave off future instability and more importantly to move rates more toward a normal long-term average (since the booming economy can handle the rate increase, this is the best time to move toward normalizing rates… in theory). On the flip side, if rates are high and the economy is slowing down, the Fed might move rates down to normalize rates and stimulate the economy.

Understanding the Fed in Terms of Monetary and Fiscal Policy and Their Mission Statement

In a more overarching sense, the job of the Fed is to promote economic stability (in a positive direction; so healthy growth and thus economic stability) while keeping employment high. The Fed they can do this by using a range of tools at their disposal which can affect mostly monetary and to some extent (at least indirectly) fiscal policy.

- Monetary policy: matters of influencing the money supply; mostly handled by central banks. The Fed affects monetary policy directly, the government does not (although they can indirectly).

- Fiscal policy: matters of spending and taxation; mostly handled by the government. The government affects fiscal policy directly, the Fed does not (although they can indirectly).

Of all their tools, of monetary and fiscal policy, most of the Fed’s tools are designed to affect monetary policy, and of monetary policy a primary and simple to understand tool is adjusting interest rates.

In a sense then, a main function of the Fed is: Adjust interest rates to promote stability.

- Thus, to the question, “what does it mean when the Fed raises rates?” It means they are projecting economic growth.

- To the question, “what does it mean when the Fed lowers rates?” It means they think the economy needs to be stimulated.

- To the question, “why does the Fed raise or lower rates?” The answer is to ensure maximum employment and economic stability by way of healthy growth.

- To the question, “how does the Fed raise rates?” The answer is, by waving a pen (all they are doing is changing the Federal Fund rate, which they can adjust at any time, but will generally adjust methodically… for example after a public speech by the acting Chairman).

The Fed’s Role in Our Government and Where it Gets its Power

The Fed, our central bank, is given the power to adjust rates by the state (see the Federal Reserve Act). However, it is an independent within government check and balance that acts as a mediator between private banks and the government; its duty is to the United States, but its authority is its own (although it is granted that power by law, it is not under the direct command of the government).

The check and balance system between Congress, the Treasury, the Fed, IRS, SEC, Commercial banks, investors, businesses, etc. is meant to ensure the health of the economy. When the economy is not looking healthy, the Fed steps in and adjust rates.

For more on the goal of the Fed, see: About the Fed at FederalReserve.gov (that link gives the full mission statement of the Fed in their own words).

TIP: The reserve is a collection of quasi-private central banks with a policy making committee called “The Federal Open Market Committee (FOMC).” That entire entity is “the Fed.”

FACT: In 1977, Congress gave the Fed two main tasks: Keep the prices of things Americans buy stable, and create labor-market conditions that provide jobs for all the people who want them. Since then it has… attempted to do exactly that.

What is the Impact of Rates Being Adjusted on the Economy and Stock Markets?

So then, “What is the impact of rate adjustment on the economy and markets?”

The impact of rates going up can be a cooling off of lending (meaning a tightening of cheap and loose consumer and business credit), which can slow economic growth a bit and result in attractive interest rates for savings accounts and bonds. This can lead to bear markets and corrections in assets as people stop speculating and using credit, and start saving and moving to safer bets.

The impact of rates going down can be a heating up of lending and credit, and a more attractive environment for speculating on higher risk assets.

When your savings account offers near zero interest, and loans are cheap and easy, and credit is flowing, and stocks are bullish… it incentivizes people to speculate.

When short term bonds and savings accounts pay well, and credit is tight, it pumps the breaks on rapid growth and incentivizes more risk-off behavior in businesses, consumers, and investors.

The feedback loop above is strong enough that, in the best of times, a single wave of the pen (an adjustment of the federal fund rate) can move mountains and change risk behavior across not only the country (but because of the impact of the US) the globe.

To learn more about the Fed and the broader money supply (reserves only account for a small portion of the total money supply), see: How Currency Gets into Circulation and What Happens to it.

TIP: Check out the chart below which roughly compares the Dow Jones (in light blue), to the federal funds rate, to treasury yields. As the fund rate approaches yields from short term bonds, it incentives risk-off behavior in the markets while at the same time making corporate and consumer credit tighter (which in theory could mean “less spending on businesses / less short term rapid growth”). Why bet on the DOW when credit is tightening and short term rates are starting to outpace gains from stocks? Well, as you can see in the chart, the answer is generally, “if you think returns on equities can outpace returns based on interest rates.” As an investor you want to maximize your returns and minimize your risk, if long term bonds will do that, you move to bonds, if short term rates will, you move to short term bonds and cash, if stocks will, you move to stocks. All that said, remember the Fed isn’t focused on markets or returns on investment, their focus is on inflation, jobs, average rates, and economic stability.

A chart showing interest rates compared to the Dow Jones (light blue) since 1955 with recessions marked in grey.

- About the Fed. FederalReserve.gov.

- Here’s how the Fed raises interest rates and why it matters. BusinessInsider.com.

- Open Market Operations. FederalReserve.gov.