Stability Breeds Instability fact

How Stability Breeds Instability in Markets: the Financial Instability Hypothesis, Irrational Exuberance, Minsky Cycles, and the Nature of Bubbles (Economic and Socioeconomic)

Stability isn’t necessarily destabilizing, but as Hyman Minsky’s Financial Instability Hypothesis eludes: long term stability breeds instability and diminishes resilience in economic markets, mainly due to psychological factors.[1][2][3][4]

Although this theory is economic, it is easy to see how the general axiom applies to other social sciences and beyond. In other words, one could as easily and accurately claim, “long term stability breeds instability and diminishes resilience in socioeconomic ‘markets,’ mainly due to psychological factors; just like it is the case in economic markets.”

In both cases we are dealing with complex human factors which go beyond the purely rational.

Below we explore both the economic and socioeconomic side of things and muse on the implications.

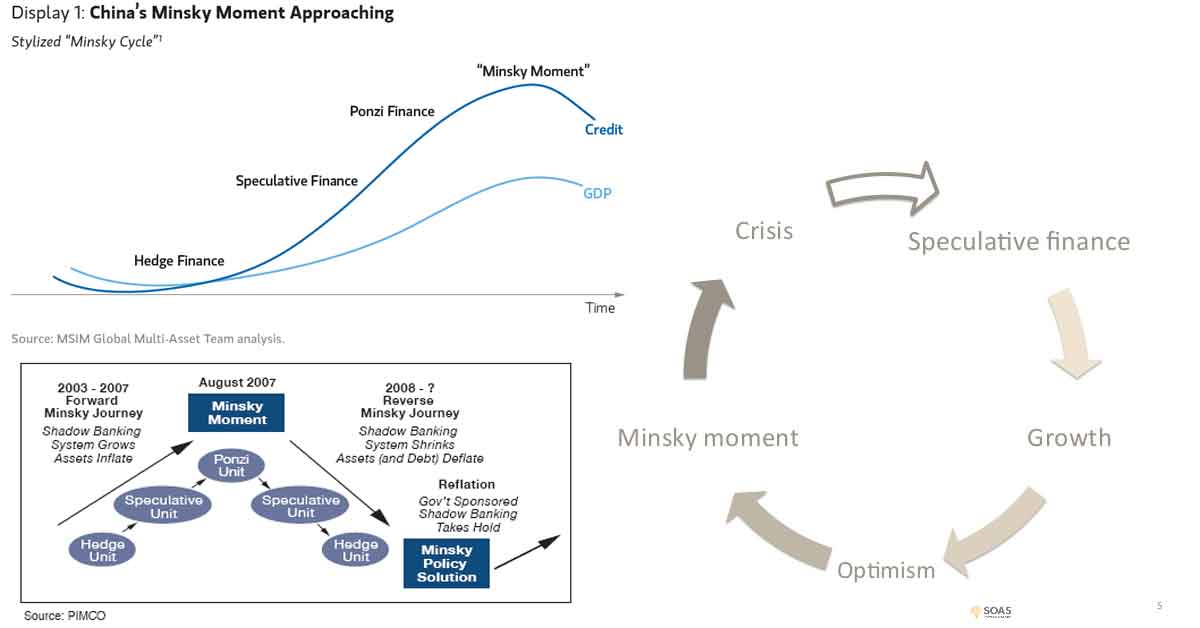

First, to grasp the above theory we need to cover two things 1. Minsky cycles (the mechanics of creditors and borrowers in relation to economic bubbles and the stages of bubbles) and 2. how the cycles relate to “Irrational Exuberance” (unwarranted optimism and risk taking) and can result in “a loss of resilience” (an inability to withstand even slight downturns after a period of exuberance AKA “cold feet and weak knees”). Lets start with Minsky cycles.

Inflation and Bubbles and Tulips: Crash Course Economics #7. This series is an excellent watch for any novice interested in learning about economics. So let’s start here.What causes an economic bubble? What causes an economic bubble to pop? In general, there is only one thing that causes an economic bubble: When assets are overvalued and prices are driven up unreasonably by speculation. Likewise, in general, there is only one thing that causes a bubble to pop: When people realize assets are overvalued and panic and thus there is more supply than demand. This is what happened in 2001 dot-com and 2007 financial crisis. The specifics are very complex, the gist isn’t. Shares of eToys, ENRON, and tranche products made up of NINA loans all turned out to be nearly worthless in reality (or at least, worth much less than the market price of the asset suggested). It was euphoric mania, cherry picked data, and speculation that drove their prices, not real metrics on earnings per-share or anything. In words, bubbles require “hot air,” a real successful company might be overvalued and lose an investor money, but it isn’t likely to be at the core of a bubble popping… you know, unless that company’s share price has been inflated to such a degree that there is ample room for popping. The core of a bubble is almost centered around less upstanding products…. although even great products are affected by the domino effect of the resulting recession or depression.

FACT: The current U.S. economy can be described as a “bubble and bust” economy. Looking at past bubbles we can see clearly that 2001 and 2007 are not “exceptions to the rule” but are rather trends. This doesn’t tell us when a bubble will pop, or if a bubble will pop, but it does remind us to use caution and to apply reason… especially in our most euphoric times.

The Logic Behind Minsky’s Financial Instability Hypothesis: Hedge Borrowers, Speculative Borrowers, and Ponzi Borrowers and the Stages of a Bubble

Hyman P. Minsky was a pioneer in defining the aspects of a bubble and bust economy, his theories can be gleaned from “Stabilizing an Unstable Economy” (1986), but can be summarized as.

- Minsky identified that a key mechanism that pushes an economy towards a crisis is the accumulation of debt by the non-government sector. Here he defined three types of borrowers who create the crisis by contributing to the accumulation of insolvent debt: hedge borrowers, speculative borrowers, and Ponzi borrowers.

- Minsky identified five stages in a typical credit cycle: displacement, boom, euphoria, profit taking, and panic.[5]

Let’s quickly discuss both.

Minsky’s Borrower Schema

As Wikipedia states clearly: “Minsky identified three types of borrowers that contribute to the accumulation of insolvent debt: hedge borrowers, speculative borrowers, and Ponzi borrowers.[6]

- The “hedge borrower” can make debt payments covering interest and principal from current cash flows from investments.

- For the “speculative borrower,” the cash flow from investments can service the debt, i.e., cover the interest due, but the borrower must regularly roll over, or re-borrow, the principal.

- The “Ponzi borrower” (named after Charles Ponzi, see also Ponzi scheme) borrows based on the belief that the appreciation of the value of the asset will be sufficient to refinance the debt. They cannot make payments on interest or principal with the cash flow from investments; only the appreciating asset value can keep the Ponzi borrower afloat.

If Ponzi-style finance is common enough in the financial system, then the inevitable disillusionment of the Ponzi borrower can cause the system to crash. When the bubble pops, and the asset prices stop increasing, the speculative borrower can no longer refinance or roll over the principal even if they can cover interest payments. As with a line of dominoes, a collapse of the speculative borrowers can then bring down even hedge borrowers, who are unable to find loans despite the apparent soundness of the underlying investments.”

In other words, a domino effect occurs where “irrationally exuberant” “Ponzi investors” crash the market, then take down semi-irrationally exuberant “speculative investors”, and then finally more rational “hedge investors” (and the whole market) generally come crashing down with them.

This is the mechanics of what happens, now lets move along to the psychological aspects of this to see how the growth before the crash led to the euphoria and “irrational exuberance” that fuels the borrowing the caused the crash and how this leads to a general lack of resilience in the market following the crash.

Minsky’s Five Steps to a Bubble

Although different authors define this differently, we can generally state the stages of a bubble as:[7]

- Displacement: A displacement occurs when investors get enamored by a new investment opportunity, such as new technologies or new low interest rates.

- Boom: Prices rise slowly at first, but then gain momentum as more and more participants enter the market. As excitement grows prices continue to rise, the investment begins to get media coverage and cause general euphoria.

- Euphoria: As excitement turns to mania people begin to invest based on emotion rather than reasonable metrics. The “greater fool” theory (that the price of an object is determined not by its intrinsic value, but rather by irrational beliefs and expectations of market participants) plays out everywhere.

- Profit Taking: In this stage reasonable investors notice that assets are overvalued and begin to cash out.

- Panic: In the panic stage, prices start to fall and sellers exceed buyers. As supply overwhelms demand, asset prices slide sharply.

Here valid excitement leads to unwise investing. In a state of mania investors invest boldly in overvalued assets. At some point, enough investors pull out and “take their profits” to cause a panic.

The common theme between these two Minsky cycles is euphoric emotional investing and an emotional sell-off. So lets move onto the key psychological factor of bubbles, irrational exuberance.

TIP: Learn more about the 5 Steps Of A Bubble from Investopedia.

Crash Course on Hyman Minsky, L. Randall Wray.TIP: Expecting a bubble to bust is a recipe for disaster, as John Maynard Keynes said wisely, “the markets can stay irrational longer than you can stay solvent.” For example, the first signs of the 2007 crisis happened when the 2006 housing bubble popped and then real red flags flew up when the new interest rates kicked in and borrowers started defaulting… yet the crisis didn’t occur until months later due to everyone trying to plug the holes. Typically there are months of warning signs before a pop and bubbles can be kept artificially inflated. Trying to time a short sell is risky, a safer strategy is to hedge and sit in enough cash to invest heavily after the pop.

Irrational Exuberance in Economic Bubbles and the Minsky Cycle

When the good times are rolling along, not in a sudden boom, but in a steady upward path or equilibrium such as it was leading up to the 2006 U.S. housing market bubble, people feel like the good times will never end and the times of hard downturns are long over.

In periods of consistent economic growth, people get restless and they take bigger and bigger risks. They think, “if I acquire this debt now, or this asset now, its value will go up over time, just like it has done in the past.” This is mild “Irrational Exuberance”, a euphoric sentiment that isn’t unreasonable, but isn’t fully reasonable either (it is optimistic).

However, at some point in the process, as increased speculation over time drives up the perceived value beyond the actual value, the mild irrational exuberance becomes more severe and what was once an optimistic “risky bet” turns into a Ponzi scheme of sorts (where the only money to be made is off selling overvalued assets before the market tanks).

When stocks are trading well over their book value, and the markets are always on the up-and-up, the rational thing to do would be to hedge against a downturn. However, this is just the environment where euphoria takes over fully and more and more people find themselves taking bets that they would have never taken in the past (the would-be hedge borrowers turn into speculative and Ponzi borrowers).

Then finally, when the bubble does break, a different type of mania sets in. A panic. In the new state of panic everyone rushes to sell off and prices plummet. The good times have gone on so long that investors, borrowers, and lenders lose their resilience and “freeze up”. This part of the cycle can then have nasty side effects like Depression and Recession. When the market can no longer rebound, we can say it has “become fragile” and “lost resilience”.

TIP: Not all optimism is irrational and there is no rule that says what goes up must come down hard. There is nothing that says that what should be a future crash won’t just be a slightly fluctuation. The more negative factors that align, the higher the probability of a bubble being busted. When the underlying assets are overvalued and “Ponzi borrowers” dominate a market, it is a big red flag… but there is no absolute certainty in the stock market.

Robert Shiller on Market Bubbles-and Busts. Profits lead to euphoria, but the passions are not the same as reason. When enough people operate on passion, rather than reason, it can lead to a Ponzi-like market.Bubbles Like Tulip Mania

Before moving on, lets take a look at an example of an economic bubble in practice.

A good example of the basics of economic bubbles and the psychology behind them was one of the first modern bubbles, the Tulip bubble (Tulip Mania).

Leading up to the tulip bubble, the prices of tulip futures steadily rose creating a booming tulip market in the 1630’s. This was only 30 years after the first public stocks were issued by the V.O.C. At the height of the bubble, long after the prices had been spurred on by a speculative demand to exceeded reasonable margins, the tulip futures marketplace of the Netherlands found itself filled with sellers but lacking buyers.

Consequently, the price of tulip futures fell by roughly 1,000% within a month as demand plummeted and a panic and sell-off ensued. The crisis was just as much about the mania turning into fear and depression as it was about an over-inflated tulip bulb market (although other factors like a resurgence of the Plague did not help the downturn).

This story is just one of many historic bubbles caused by speculation, debt, euphoria, and a range of psychological and physical factors including the bubble that caused the 2007-2008 financial crisis.

Now that we have the basics of Minsky and bubbles down, lets talk about this all again in terms of Minsky Cycles and Minsky Moments.

What causes economic bubbles? – Prateek Singh.A Summary of Minsky Cycles and Minsky Moments in Relation to the 2007 Financial Crisis

Now, lets look at bubbles and Minsky in relation to a more recent mania, the events leading up to the 2007 Financial Crisis.

The 2007 Crisis started like any other one.

What started out as “risky bets”, turned to pure speculation, as growth in the housing market and profits from related securities products boomed. As prices rose, it created an irrational exuberance and more and more investors turned to speculation. Then, at the height of the Mania which followed the period of stability, when the risky bets seemed even more attractive than safer bets, it eventually became little more than a Ponzi scheme based on mortgage-based securities (MBS) backed by sub-prime loans.

In this manic environment, people used riskier and risker forms of credit from lenders to make high-risk loans, only to acquire more and more debt and debt-based assets at a highly inflated prices.

Then it all came crashing down.

When a house was bought on a NINA loan in 2006 and, interest aside, the value of the asset quickly fell below money owed on the principal itself, the loan often went into default. When the loan went into default, the value of securities fell. Those who had speculated on credit could no longer make good on debt, and the lending industry froze up. In words, once people and financial institutions realize that they are holding “the hot potato,” they had “a Minsky moment” (AKA “they panicked”).

Prior to the onset of the financial crisis, lenders extended large amounts of credit with the idea that the loans would be repaid and markets would keep rising. When they realized the boom was over, they did an 180-degree turn and stopping lending. Lenders began calling in debts. In 2007, for instance, banks stopped lending to each other and all started calling in debts when they realized they had chopped up the hot potato into tranche products and spread them throughout the market.

When the good times are good, and things are steady, it is not human nature to think, “what if the times aren’t always good?” Considering humans are the agents or players in any given market, be they bankers, holders of 401ks, shoppers, employees, or employers, markets are forever bound to be impacted by individaul and group psychology.

What is a “Minsky moment”? A Minsky moment is a sudden major collapse of asset values that occur after long periods of prosperity increase the value of investments. It leads to growing speculation using borrowed money.[8]

TIP: The above is true for any socioeconomic system, not just for money markets. It can be said to be true for any system where the agents are people, and thus group and individual psychology are in play. There are different types of capital, value, and markets and each has psychological elements which can become even more important than the underlying assets being traded in these markets. As you can see from the videos on this page, inflation, depression, bubbles, deflation, recession, etc. are as much about psychology as they are about debt, credit, speculation, or, as noted, even the underlying assets (although to be clear, in 2007, the underlying assets were “not great”).

Recession, Hyperinflation, and Stagflation: Crash Course Econ #13.The Economic Consequences of Sobering Up: Instability and Fragility

All physical factors aside, it wouldn’t be so bad if habits and psychology didn’t change when the panic set in. At the start of the Great Depression, many people made a run on the banks and changed their habits overnight. Sudden changes in action and attitude led to disaster for many.

Once people realize they are in a financial crisis, instead of remaining calm, they tend to make a run on the markets and suddenly freeze up. They become unwilling to take even moderate risks, and thus unwilling to participate in the economy and affect the velocity of money. Thus, it is largely the psychological factors that are a response to the bubble which causes the recession or depression after the bubble has popped as prices deflate, debts become due, payments default, and there is a downturn.

After an extended period of stability, the economy cannot “withstand even modest adverse shocks” because the period of stability has caused the market lose its “resilience.” Thus, instability occurs in the new environment of fragility due to the previous environment of security in which resilience has been lost.

The Economist’s Version of Minsky’s Theory Focused on Resilience, not Stability

To state the above again, in terms of economics, as this well-written blog quotes Laurence Meyer:

“A period of stability induces behavioral responses that erode margins of safety, reduce liquidity, raise cash flow commitments relative to income and profits, and raise the price of risky relative to safe assets–all combining to weaken the ability of the economy to withstand even modest adverse shocks.”[9]

Or, like the same blog says, quoting Holling and Meffe‘s Resilience and Stability of Ecological Systems:[10]

“Resilience determines the persistence of relationships within a system and is a measure of the ability of these systems to absorb changes of state variables, driving variables, and parameters, and still persist. In this definition, resilience is a property of the system, and persistence or probability of extinction is a result.

Stability, on the other hand, is the ability of a system to return to an equilibrium state after a temporary disturbance. The more rapidly it returns, and with the least fluctuation, the more stable it is. In this definition, stability is the property of the system, and the degree of fluctuation around specific states the result.”

Stable markets produce “weak knees” and, over time, the resilience to withstand downturns is lost. People are more likely to panic and make a run on the markets once they lose resilience. Meanwhile, unstable markets produce high resilience (see paradoxical effects). Thus, stable markets are destabilizing, not only in that they incentivize risk, but they also weaken the ability to withstand “even modest adverse shocks.” Of course, highly unstable markets are also destabilizing, so there is a catch-22 of sorts. Thus, we are taught a lesson of being wary of extremes more than any single factors alone.

Summary

When things go well, people take more risks. In economics “they hold more debt” and “take more credit” in the hope of short-term profits. This drives the prices of high-risk assets up more than lower-risk assets. When this happens for long enough, the market loses its ability to bounce back, which we call “losing resilience.” Several factors join to lead to a bursting bubble. The accumulation of debt rides on an assumption that trends will not end or reverse themselves. This feeling becomes mixed with a market that lacks resilience. Stakes are raised higher and higher. When a downturn comes, the dominoes fall as properly valued and overvalued assets both fall in a chain reaction. See hedge borrowers, speculative borrowers, and Ponzi borrowers below. This may lead to a full-blown recession or depression. Disaster may be staved off with “a visible hand,” which can help save assets and return “confidence” to the market.

The Lessons

The details are complex, but the concept is simple and so are the lessons we can learn:

- We need to factor in social factors like euphoria into any socioeconomic theory.

- We need to factor in credit, debt, and instability when looking at socioeconomic models.

- We need to regulate private entities who would otherwise take risky bets that risk significant socio-economic destabilization for short-term gain, whether we mean a political bet, an economic bet, or other.

- And most importantly, things don’t work well in extremes.

In other words, the spirit of the laws should be one that enforces moderation, avoids extremes, and factors in both the good and bad times.

Robert Shiller on How Human Psychology Drives the Economy | The New School. A lecture on the psychological factors of markets.TIP: Neo-Classical economics (the evolution of Adam Smith’s classical economics) and Neo-Keynesian (like… Keynes’ General Theory modified by modern economists) are the two main types of economic theories. Neoclassical theory says, “goodbye Glass-Steagall. Less regulation is best; the free-market is liberty at its finest; people are rational; let the good times roll and the trickle down trickle.” Meanwhile, Keynes says, “the free-market is good, but a mixed-market is better, sometimes the invisible hand needs a helping hand.” Minsky is a post-Keynesian economist. Post-Keynesian economists are united in maintaining that Keynes’ theory is seriously misrepresented by the two other principal Keynesian schools: neo-Keynesian economics, which was orthodox in the 1950s and 60s, and new Keynesian economics, which, together with various strands of neoclassical economics, has been dominant in mainstream macroeconomics since the 1980s . Alan Greenspan’s Monetarism and other economic theories are part of neoclassical economics. While the general mechanics of markets are clear, there is little agreement on what theory to use or what factors to factor in. Other theories are also in play, such as Modern Monetary Theory, which is focused on fiat currency and based on both Keynes and Minsky and neoclassical synthesis which is a synthesis of neoclassical and Keynesian economics.

Economic Schools of Thought: Crash Course Economics #14.TIP: It may seem unfair that extreme inequality, equality, and equilibrium all cause instability in socioeconomic markets… but the world is complex and it really does seem to work that way. The key is keeping a cool head and making sober reason-based judgements about what one is investing in.

Financial Instability Mini-Documentary.- Hyman Minsky

- The Financial Instability Hypothesis* by Hyman P. Minsky The Jerome Levy Economics Institute of Bard College

- “Stability Breeds Instability,” Or Why John Taylor Is Angry

- Hyman Minsky

- Minsky’s Borrower Schema

- Minsky’s Borrower Schema

- 5 Steps Of A Bubble

- Minsky moment

- resilience, not stability Minsky’s Financial Instability Hypothesis and Holling’s conception of Resilience and Stability

- Resilience and Stability of Ecological Systems