How Isaac Newton Actually Lost His Money in the South Sea Bubble

The Lesson Newton Taught Us About Market Physics (How to Calculate the Madness of Men)

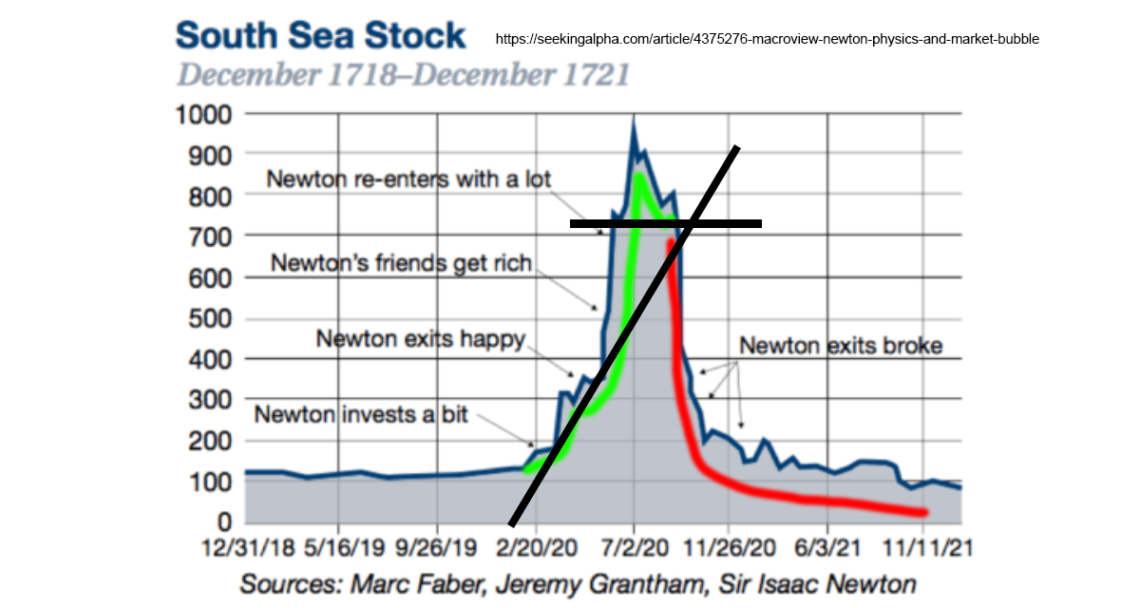

Isaac Newton didn’t just buy the top in the South Sea bubble. He bought early, sold for a modest profit, then bought back in near the top after seeing others get rich, only to sell near the bottom for a loss of £20,000 (roughly £1.2 mil in 2021 adjusted for inflation).

In other words, Isaac Newton was early and made money in the South Sea bubble… but still ended up losing a lot of money anyway.

Any investor or trader in any time period can learn a lot from this story, as the story has less to do with Newton and the South Sea Bubble than it does with bubbles and market psychology in general.

When we initially hear that Newton lost money in the bubble we might be tempted to think he wasn’t a good investor or that he just got in late. However now you know that this wasn’t the case. He was in early, then he sold early, and then after watching others get rich he went in heavy near the top.

Going heavy into the top of a bubble expecting to make what other people made up on the way up is a very human mistake to make, but it can also be a very costly mistake if one has no exit plan.

The reality is, although Newton made many little mistakes, Newton’s main mistake wasn’t the initial sell, it wasn’t the emotional buying back in near the top, it wasn’t the amount he spent, and it wasn’t even selling near the bottom later (he could have easily sold lower; so selling when he did was for sure not a mistake).

Newton’s main mistake (the one we can all learn from) was not accepting his loss and not selling when the trend turned against him.

Ideally, Newton would have held his initial position or added to it instead of selling, not jealously entered heavy after watching his friends get rich, not fooled himself into thinking that just because he had been right before that the timing was right now, not tried to make up for lost gains by betting big, etc. But the damage caused by all those underwhelming yet natural moves could have mitigated by cutting his losses with the same gusto he bought back in.

As you can see from the chart featured above, if Newton had just taken a small loss when things started looking grim he would have saved himself a fortune. Yes, he would have lost money on the big bet, but not much compared to what he did lose, and the little money he made before would have offset the losses somewhat anyway. If he did this, there would be no story.

Likewise, if he had held his initial position and added as the price went up, he would have actually come out ahead if he sold when the trend turned against him or would have at least had more manageable losses if he sold when he did in practice. Again, no story.

Instead, Newton managed to turn a good play into a bad one.

Again, the only way this could have gone worse was not selling or buying more on the way down (doubling down on a loss).

The core of what went wrong was holding against the trend, but the many factors that led to the situation are perhaps even better to analyze (since they are timeless mistakes made by every generation in every bubble).

Without further ado, the morals of the story go something like this:

- If you are early on something and sell or don’t go heavy, then it does really well, you are almost certainly going to do what Newton did. You can either sit out of the asset forever, or you’ll have to figure out your entry and exit. Good ideas include buying right back in as soon as you realize this or making a promise you’ll sit out and find other assets. Don’t let it eat at you until you Newton-in at the top and hold all the way down.

- If you miss the bubble, wait for the next uptrend. Buying into the downtrend after you miss the bubble is bad news. Many assets bubble once and then vanish like South Sea Company stock.

- Buying into a bubble, getting FOMO, etc are not necessarily bad… if you are willing to sell when the trend turns against you. There is no wrong time to buy into a bull market if you are a trend trader… because you won’t hold on the way down.

- Betting more than you can afford to lose is never a good idea, but most people will do it.

- Doubling down on a loss should be avoided. Newton would have been worse off had he done this (although him not selling was a bit this).

- You are less likely to be satisfied with small gains or to take small losses if you wait out a bubble and watch others get rich only to get in late. You want your 10x – 100x like they had, you won’t settle for modest gains and losses. Thus you will likely take heavy losses.

- It is better to hold and buy in a bull trend and sell in a bear trend. If you can’t identify a trend, take the time to learn.

- Being happy with modest gains is a good way to avoid heavy losses.

- Newton is said to have said, “can calculate the movement of the stars, but not the madness of men.” Despite what Newton says, we can for sure calculate the madness of men and markets. We just did basically (I mean I gave you the rough sketch of it at least). It isn’t that we can’t calculate it, it is just that with all the excitement it can be hard to pay attention to the math over the emotion is all.

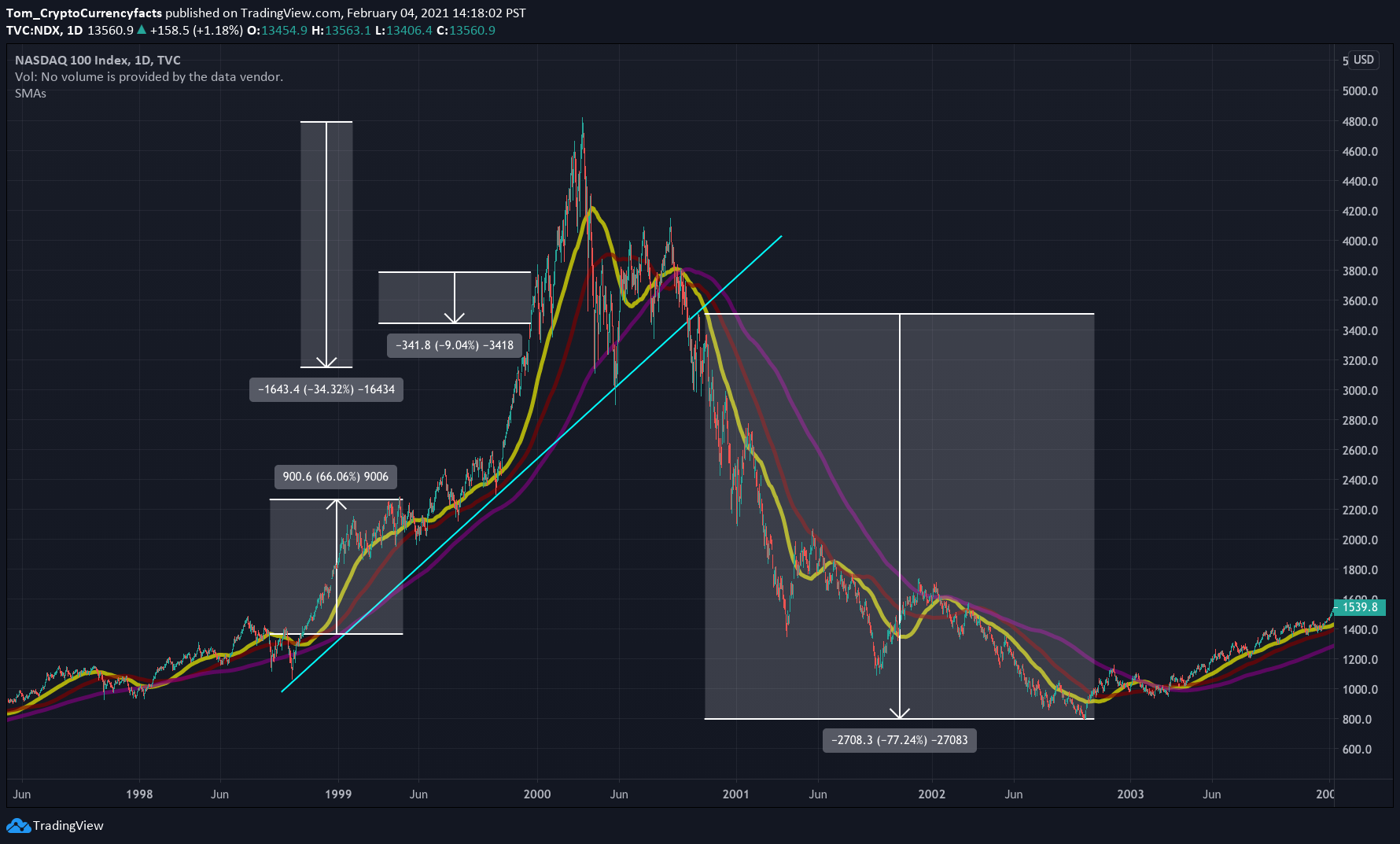

TIP: When trading bubbles, pick a simple trend strategy like the 50, 100, 200 MAs featured below. If the price goes under those moving averages, if they start to cross, get out. Any simple version of this, even just using some simple trend lines, will get you out of the South Sea bubble (although if it is a quick bubble, you’ll need to likely use shorter moving averages). Yes, bubbles can happen quickly, but not so quickly that you have to hold to your doom. You have time to cut your losses.

EXPLAINING THE IMAGE BELOW: I know the image below is a lot to look at. But let me explain. This Newton’s bubble applied to the dot com bubble. The 66% is like Newton’s initial gain. Very cool, but not good enough after watching his friends get rich. The -9% is what Newton would have lost if he sold when the price crossed under all the moving averages and trendlines. -34% is what he was down from the top (oof, hard to avoid that without guessing the top, but way better than the 77% loss from the trendline if you held). Hopefully, this illustrates why a basic trend trading strategy and cutting losses is way better than what Newton did. Now of course if we are going to put £1.2 mil on the line we’ll spend more time making the chart pretty (£1.2 mil is what this site will likely pay me in ad revenue over an infinite time period according to historic trends, so forgive my brevity), but hopefully, at least this helps illustrate the gist.