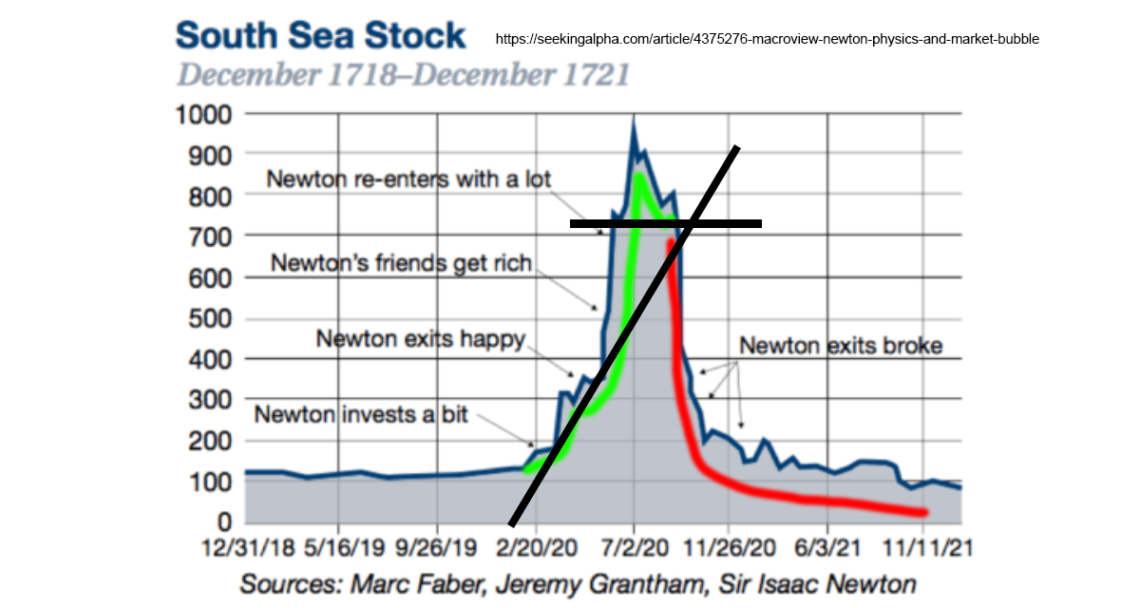

How Isaac Newton Actually Lost His Money in the South Sea Bubble

Isaac Newton didn’t just buy the top in the South Sea bubble. He bought early, sold for a modest profit, then bought back in near the top after seeing others get rich, only to sell near the bottom for a loss of £20,000 (roughly £1.2 mil in 2021 adjusted for inflation).