Are We in the Middle Of An Everything Bubble?

Opinions on The Theory of the Everything Bubble

Some claim we are in the middle of an “everything bubble” (an economic bubble, not of an asset, but of everything). We examine this claim and offer opinions.[1][2][3]

NOTE: I’m not an economist, I am just a researcher taking a look at a claim that has been made in recent history (for example here: The Everything Bubble – Waiting For The Pin; please see the citations for other articles on the subject). On this page we aren’t trying to label that claim true or false (i.e. fact or myth) with certainty, we are just exploring why the theory does or doesn’t have weight. Further, this isn’t meant as “FUD,” it is just an academic exercise. If anything, the idea would be more toward about keeping one’s FOMO in check and opening one’s mind to the idea of an everything bubble, not about panicking and shoving gold bars under one’s mattress (I find that sort of negative fear mongering not useful to say the least; especially given how long bubbles have historically remained inflated after they should have popped).

NOTE: The following video is an example of the “everything bubble” claim. A lot of people who note this bubble end up pushing a product as a hedge (such as precious metals as a hedge). This is to say, many who bother to warn of the potential everything bubble also seem to have an angle (and that angle is almost always products or positions that would benefit from an everything bubble popping or from people being afraid of an everything bubble). Let’s put aside fear, hidden intentions, and products, and just muse on the concept of an everything bubble. With the above points in mind, the following video makes some valid points.

The Everything Bubble: Stocks, Real Estate & Bond Implosion – Mike Maloney.Why The Everything Bubble Theory Makes Sense (Looking at Past Bubbles in Equities)

To understand the potential looming everything bubble, it can help to understand it in relation to past economic bubbles. To do this, let’s compare a bubble in a specific asset to what looks like the formation of another bubble currently.

Look at the NASDAQ composite chart (also featured below). You can see that the bubble from 2000 is dwarfed by the current bull run (constant upward trend) that began in 2009.

The NASDAQ composite is a tech heavy index of 100 U.S. companies listed on the NASDAQ exchange (referred to as “the NASDAQ” below and typically tracked via the “NDX” and invested in via the broader “QQQ”). Thus it is useful for looking at the 2000 dot-com bubble in comparison to the current state of things.

Feel free to compare this to other popular indexes with different cross sections of companies (with less of a focus on tech) like the DOW and S&P (one can see dot-com bubble and the housing bubble and 2007 crisis this way too; on those charts the current run really stands out compared to those bubbles… which is even more troublesome from some perspectives).

A price chart of the NASDAQ since 1998 illustrating economic bubbles. We don’t have to be at the place on the chart where the red arrows are pointing (there is no law of history repeating in fractals)… but, it is worth considering. If history was to repeat, we are in for a period of parabolic growth and lots of chop leading to a pop. This looks less scary on a log scale, but the gist is the same anyway you slice it.

NOTE: Just from a technical perspective the charts above look ominous, but not hopeless. If it was just technical, it would be one thing. However, pairing the technical with the “everything” is logically more concerning (because technically and fundamentals create a feedback loop where each can drag the other down or pull the other up and reflect the other). Here in late 2018 seeing things like trade wars, rate hikes, a major tax cut (which created the price action from 2016 – 2018, thus giving us more room to fall), job growth slow down, a general decline in sales vs. expectations, turmoil with Brexit and the loan side of banking, banks with zero interest bonds taking a toll on balance sheets, high PE ratios, and more… some of these things had been clear when I first wrote this, some not. The problem is the compound effect all of this can have in a crisis. That is to say, the problem is “what happens to everything if and when everything starts entering a tail spin at once or in quick succession?” The answer to that is logically, but hopefully not, a downtrend like the one in the Nasdaq chart above.

It is Hard to Look at the Formation of a Bubble and to Say “That isn’t a Bubble;” Yet, it is Common to Do So

The story we see just in the charts above is the same. We currently see something that looks like the bullish side of an economic bubble (it looks a lot like the run up before 2000 and 2007). In fact, in terms of classic economic bubbles, what we are seeing is pretty text book.

The text book doesn’t say the bubble has to pop, or that we don’t have a lot more room to run, or that a pop has to look a certain way, or that a pop can’t look more like a 10% – 20% correction than a full on depression. The text book simply hints that, unless humans and markets have fundamentally changed in very recent times, the chances of this not going into a parabolic uptrend that results in a popped bubble and then correction leading to a few failed rallies and then a crash is near zero.

Further, the book would tell us that the crash can in the worst case lead to a recession or even depression… and that is just in equities (never mind other aspects of the local economy like houses, loans, credit, debt, dollar values, etc and the global economy).

To the above point, even though this is a price chart of a basket of U.S. companies, we can note that the U.S. is largely at the center of the world’s economy and the world has largely been mirroring the same sort of ethos’s and actions of the U.S. in terms of how economies function at a consumer, corporate, and state level. So we can generally say that, just like past bubble pops have rippled throughout the world, so too logically would this one if it does pop.

TIP: One place to look for bubbles is cryptocurrency, consider the Bitcoin charts below. Can they tell us anything about what speculators do when they blow bubbles? Do they support inflated prices? Or do they use derivatives to profit once the uptrend becomes unsustainable? Is this the same as what retail investors do in their retirement accounts, or will the average investor suffer a different fate? We all know the answer there, and if we don’t, we can look to the IRS data on cryptocurrency gains and losses once it comes out or go back and look at gains and losses from 2000 or 2007.

Bitcoin, it just sort of does this over and over. If we weren’t in some progressive stage of an everything bubble, I really don’t think we would have seen Bitcoin speculation ramp up on such a massive level. It is like a canary in a coal mine. This quick moving and bubbly asset is I think foreshadowing things to come. Before you dismiss what I am saying, take a look at the 21 year chart of Amazon or the NASDAQ above.

To Pop a Bubble

All that said, to pop a bubble, it takes more than constant growth (that is the least of anyones problems, constant growth is actually a pretty good thing).

For a bubble to pop, it takes speculation that inflates the price tag of assets well beyond their fair values / book values and it takes a catalyst (a pin that pops the bubble).

In the housing bubble speculation brought prices of financial products consisting of sub-prime loans well beyond their book value, and the pin was the realization that the underlying assets were near worthless (as for complex reasons people began to default on their loans causing a ripple effect; I explain the mechanics of this here).

To pop an everything bubble is more complex, because it isn’t a bubble of just one market, it is a bubble of substantially all markets (enough markets in the U.S. and across the globe to be considered “everything”).

Further, one should note that the housing bubble pop was staved off for some time via monetary and fiscal policy. In fact, the bubble was inflated more than it would have been as an advent of the pop being staved off (this seems to be common in bubbles). Banks and government in the U.S. were able to stave off the U.S. housing bubble, imagine the forces that will be at work across the globe to stave off an everything bubble (it could result in a long gap between the point where it should have popped and where it does, if it does).

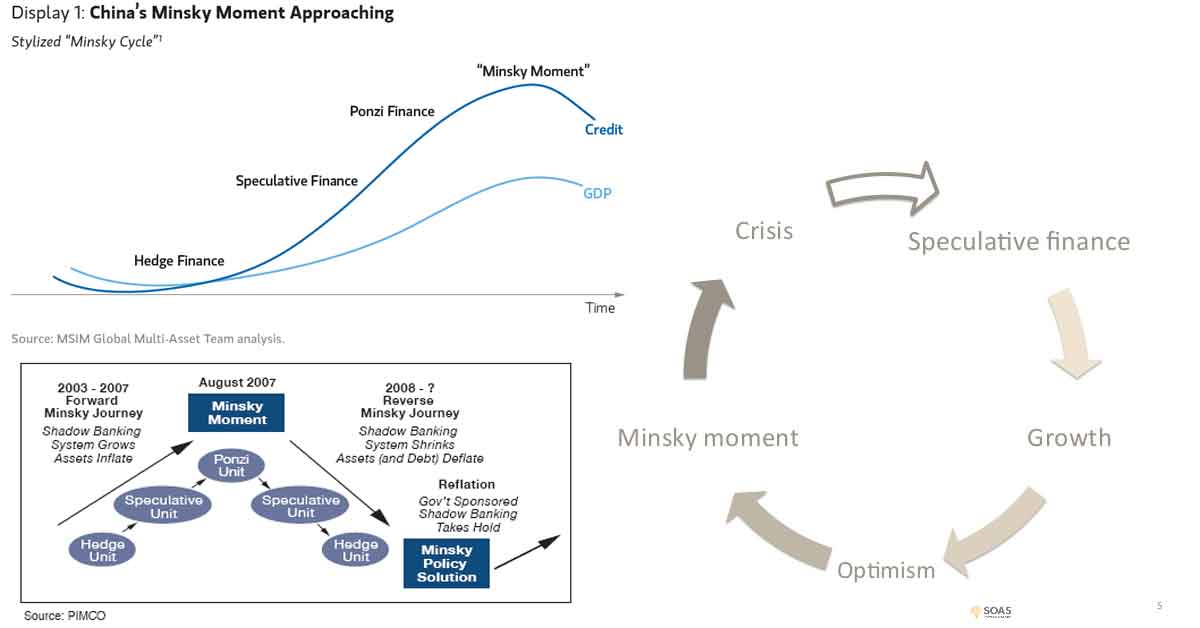

The mechanics are complex, but the gist isn’t. The gist is humans create bubbles via speculative finance and credit (generally mixed with what in retrospect ends up being bad policy), and they pop when the policy and practices of big banks, companies, investors, and government can no longer stave the popping of the bubble off.

It has always been like this, there is no reason to think it won’t be like this again (as humans and markets did not fundamentally change between now and the last time they caused the last bubble).

How the Bubble Could Pop (theory from Nov 2018): My theory on how the bubble will pop is not unlike other bubbles. First a sector or two pops. So let’s say crypto pops (foreshadowing more substantial markets), then tech pops. This leads people into other asset classes, they then bubble, and before the other markets can rally back those pop. This downward pressure pushes large players and technical traders to sell (as this set of events has by this point forced major indexes under their 200 day moving averages and painted some death crosses). With stocks lower we have a corporate bond crisis (corporations can pay back bonds with stock as long as share prices are high enough). Now companies are down from prior buy backs. it all compounds, and it drags “everything down.” Adjusting interest rates isn’t enough, national debt grows due to bailouts and such, and the increased debt hurts not only bonds, but dollars (causing a ripple in Forex markets). External factors like trade wars and crashing world markets don’t help. Etc.

Why the Everything Bubble Might Pop

The above is the basics, but now we want to know about what makes this an “everything bubble” and not just say “a tech bubble” or “housing bubble” or “Bitcoin bubble” etc.

The answer to that is found in the charts of everything, book values of everything vs. prices, interest rates, national debt, debt to GDP, and current regulations and lending practices.

Simply put, there is a pretty hefty premium on almost everything (with some assets exceeding book values by absurd amounts; see Schiller PE on the S&P for example), interest rates are a raising slowly but were previously near zero (low rates are good for growth, high rates tend to be found in times when growth is slow, and although rates can be negative, there is only so much room to lower rates even further… I think this is why they are slowly raising them now in the U.S.), national and personal debt is high (not just in the U.S.; debt means interest, compounding interest for families and states can have a range of complex nasty effects), and current regulations and lending practices are loosening (less regulations, more lending and credit, which means more short term growth).

This sets the stage for increased speculative finance based on credit (personal credit and national debt) which will further increase premiums paid on assets (stocks and houses for example) which will result in more debt.

This then makes investors more bullish and has them taking more risks and using more credit, and thus creating more debt, which can only be paid off if everyone is able to sell for a profit (impossible).

That all causes the bubble to inflate even more. Then government and central banks will step in to stave off the pop. Which kicks the can down the road and causes the bubble to inflate even more. And like un-payable interest, it compounds only to make the problem worse.

Right now many companies are priced like we are considering their value in 20 years from now [slight hyperbole in many cases; but not in all cases], in fact, premiums haven’t been this high since 2000 bubble and great depression on average!

It is almost absurd really in some cases, we have already priced the future into things in the present to such a degree that the only thing to price in in the future will be the even more distant future… and yet on top of that, speculation is pushing the price up even more. And since this is likely to go parabolic before it pops, we are likely to see this all become more absurd.

This could go on for years, heck decades even! There really is no magic point at which a bubble must pop, especially an everything bubble, especially if policy staves it off.

After-all, if people are willing and able to pay 100x more than book value for a stock, then the market will accept that gladly.

Further, this could play out in a way where certain bubbles pop in a staggered way that avoids everything popping at once. So it isn’t like everything has to pop at once, as it is not all the same thing.

NOTE: An apple is a very good fruit. It is worth picking from the tree, is worth $1 in the store, and if you are hungry $5 might seem like a fair price. However, an apple is not priceless. At no price does it become less delicious or desirable, it just becomes increasingly less reasonable to purchase. Given the historic price of apples, if the price of apples shot up to $100 each, you wouldn’t buy them unless you thought you could sell them for more, and rather quickly. If you thought you could sell them for $110 tomorrow, because the price of apples just kept rising, you may take out a high interest loan to buy more. That is irrational exuberance and speculation in action; there is logic to it, but it isn’t reasonable or sustainable. And that is illustrative of the problem with high premiums on otherwise great products. The integrity of American companies isn’t in question, neither is their ability to do that which should result in increased earnings, the premiums compared to book values are the problem (not to mention the systemic effect and the total consequence of an everything bubble where personal debt results in less buying power, which means regardless of how good the apple tastes, it can effectively become impossible for the retail customer to consume).

Other Points to Consider

There are a ton of data points that I can point to, and I’ve linked a few articles in the citations that make this points. However, I don’t think pointing to specific historic price vs. earnings trends, debt, inflation, stagnating wages, a growing wealth gap, historically low interest rates, a laissez faire attitude on spending, regulation, and speculation across the globe from communist states to capitalist ones, etc is really in order here.

I’m not an economist, I’m just an investor, trader, and researcher who happened to notice a giant elephant in the room that many other people are looking at (but many more are ignoring).

That elephant is a giant everything bubble that is manifesting itself in the attitudes of the world. No way watching that pop will be pretty, but it also won’t probably be as bad as the doomsday talking heads say.

Bubbles pop all the time, people lose money on paper, and then at some point the popping stops and people start making money on paper again.

There isn’t enough paper money for everyone to shove their cut under the mattress, and actually bubble pops are a natural and efficient way of dealing with this truism (and… um, consolidating wealth in the hands of the wealthy).

That last point, unfortunately, the working classes and their 401ks and pensions are likely to take a hit while the rich and their money managers nimbly move assets around and short the top and double top (bubbles tend to produce a long top and then a rally to try to get back which produces a double top before they crash; it is really, really common, so common I’m not even going to bother talking about rare instances where a bubble doesn’t look like this, see the charts noted on this page).

Equally unfortunately, we as a globe are likely going to deal with this with more borrowing like we have done in the past (i.e., dealing with it with credit).

At the same time, as prices trend toward book values and interest rates rise, it’ll give us all time to reset and start the cycle all over again. And it is in that phase that one can find really good deals on things like real estate and stocks (assume one protects their capital during the correction, crash, criss, recession, depression, etc).

One last benefit, it is unlikely wages for those lower down the totem pole will go down, as there is hardly ever a decrease to the minimum wage. Thus, one might ponder if the everything bubble won’t actually increase the purchasing power of the lower classes? Still though, credit would tighten and since that class operates on credit, that isn’t good either.

Well go figure, the everything bubble popping (if it is a bubble, and if it pops) would be mostly not good. I won’t sugar coat it.

Of course all that said, nothing HAS to happen. Bubbles don’t have to pop, it is simply that they always do seem to in practice and thus one probably wants to be at least a little cautious about 1. taking out tons of credit, 2. going all-in with a self managed retirement account or overextending in capital asses with no exit strategy, 3. buying a house or other investment property during a boom, 4. becoming a doomsday bear before this actually shows signs of popping (since it could get much worse before anything like that happens).

In short, I’m not an economist, and I can’t give investment advice… but you really don’t need that any way. I am just doing what anyone can do, that is looking at the history of economic bubbles, trying to figure out why they popped, and trying to be aware of what worked in those times. Most people can open short positions in a bubble pop, but not overextending yourself toward the top in a fit of mania and greed is a darn good close second.

NOTE: Imagine it is 2005 and you see the 2007 – 2009 financial crisis coming. Or, it is 1998 and you see the 2000 tech bubble forming. You are way early to the party in these cases. If you trade all your equities for gold bars and bullets and go live in your bunker, you’ll miss some really great opportunities and you’ll actually risk opening yourself up to FOMO (buying high due to the fear of missing out). So don’t go panicking over some theoretical bubble, just be aware of the elephant in the room and try to avoid getting caught up in the mania at the height of the mania without an exit plan.

TIP: People suggest investing in growing foreign markets because of the lack of room to grow in the U.S. due to the premiums on stocks. I get the logic, but that sounds like the sort of thing we will look back on as being a sign that the bubble was getting really bubbly. It is sort of like running out of countries which can be exploited for cheap labor; a valid point, but a little mad when you take a close look at it. When we could no longer speculate on our own assets, we turned to theres… “the everything bubble.”

TIP: There is an idea that some assets, like precious metals, Bitcoins, or bullets are recession proof. That could be the case, but I do wonder if that old hat trick will really work this time? Is an EVERYTHING bubble not a bubble of everything including metals, Bitcoins, and bullets? It is sort of like the VIX. Not everyone can offset a crash by being in the VIX. At best those failsafes would just bubble and bust themselves as everyone piled into them (look at Gold for example; yes it was a great hedge in 2000, but that just led to a bubble). Not saying diversifying into some of these types of assets isn’t smart, I’m just wondering out loud if the parachutes are really going to open when everyone starts jumping out of the plane during an “EVERYTHING” bubble. Since we can’t know, it makes sense not to put all your eggs in one asset type in my opinion.

TIP: The housing bubble arguably should have popped at least a year, if not more, before it did. No one wants bubbles to pop, so everyone staves them off. This tends to accelerate the bubbling. This helps us to understand why there is almost always a parabolic phase before the bubble pop. Right now I’m personally not seeing any parabolic phase. I guess that phase doesn’t have to occur, but it is present in so many economic bubbles it would be odd not to see it. Since there is no parabolic phase, it is likely the bubble won’t pop soon. Meanwhile if you look at some policy like the FED policy, it is already working to stave off the bubble. Meanwhile, fiscal policy of states seems to be working in the opposite direction.

IMPORTANT: To be clear, this is all armchair opinion of a non-economist. I would actually be very happy to be wrong. The above comes from a simple place, after researching bubbles and watching a few pop I just wanted to put my thoughts down about the concept of the everything bubble that people talk about. I think it is a reasonable theory, but heres to it not happening!

- The Everything Bubble – Waiting For The Pin. SeekingAlpha.com.

- The ‘CAPE To Saving Rate’ Ratio Signals A Terrible 2018 For U.S. Stocks. SeekingAlpha.com.

- Opinion: S&P 500 should be 1,000-plus points lower than it is today, strategist Rosenberg says. MarketWatch.com.

Steve

Great write up. Still looking for strategies and doing research myself. I think it will pop but like you say I think we have some time to look for the right place to park.

Fernando

Thank you very much for this very interesting and informative article, it really helped me grasp the background of the so-called “everything bubble”.

I do agree that what we are seeing is a huge, text book-like economic bubble. As both monetarists and orthodox economists say, the huge supply of credit that flowed into the market through quantitative easing(not only in the US but in part of Europe as well) probably gave speculators a lot of leverage for buying and selling all kinds of assets in order to earn considerable profits, thus inflating the prices of everything. Forgive me if I am mistaken, but as far I am concerned all economic bubbles form following a trend of loose monetary policy and “cheap money”.

Another interesting way to look at the prospects of a looming economic crisis is to check the series

10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity (https://fred.stlouisfed.org/series/T10Y2Y) from the FRED. Whenever this difference is bellow zero, it has indicated, up until now, with 100% accuracy that a crisis is “about to happen”(even though it still might take a couple of years).