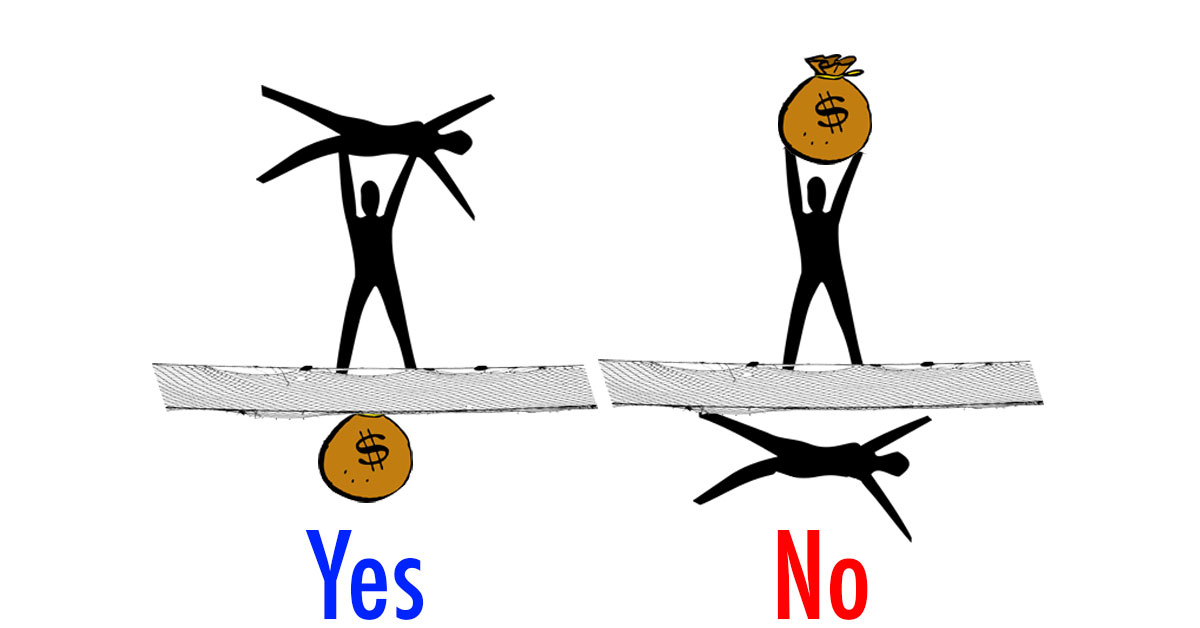

The Welfare Traps, Tax Traps, and Debt Traps

There are a number of traps created from both taxation and assistance that inhibit class mobility. We might generally call these welfare traps, tax traps, and debt traps.

Economic inequality describes the income or wealth gap between individuals in a group and between groups. The term also typically implies the negative social consequences of the wealth or income gap.

There are a number of traps created from both taxation and assistance that inhibit class mobility. We might generally call these welfare traps, tax traps, and debt traps.

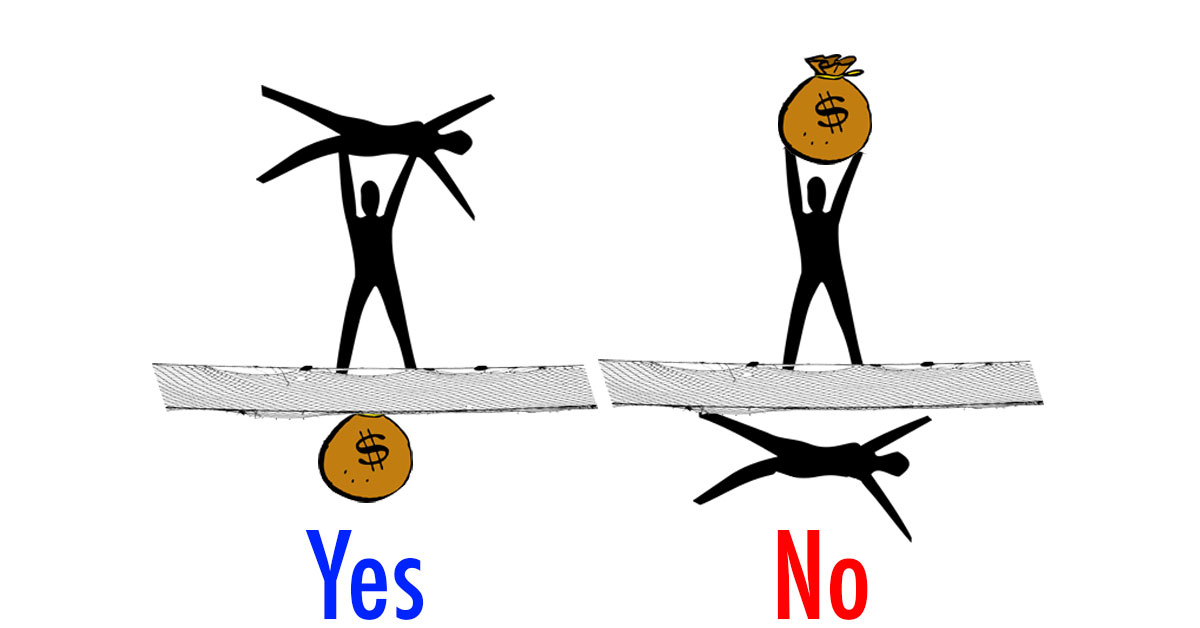

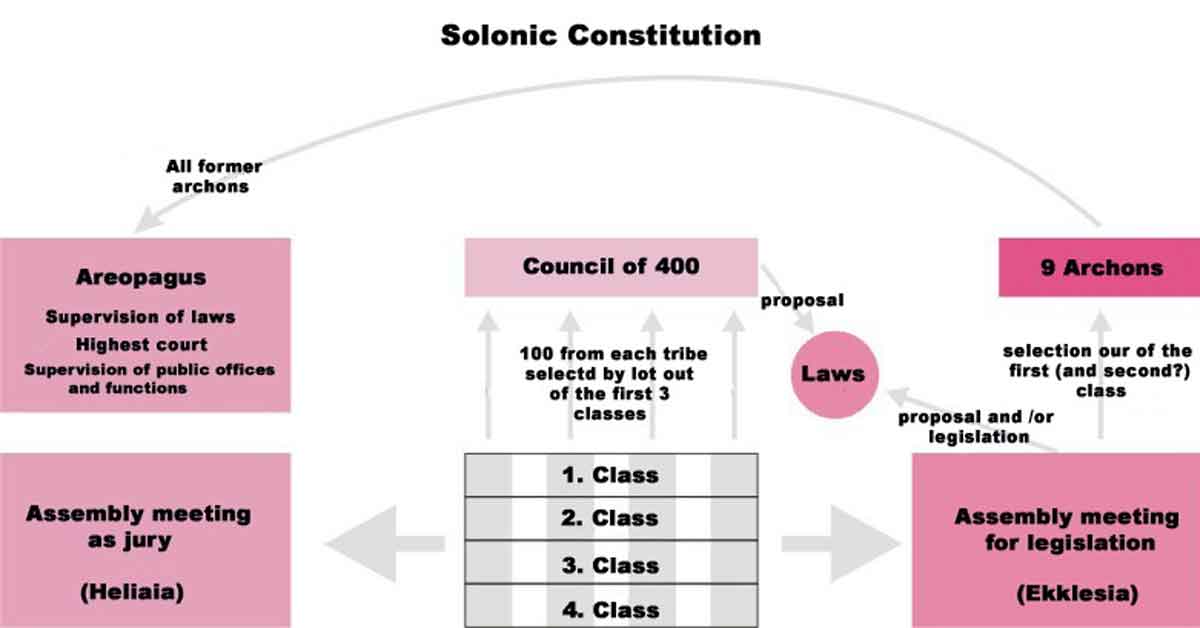

The Athenian Constitution tells the story of how Solon liberated the people by cancelling all debts, public and private. This was called the Seisachtheia [the removal of burdens or relief of burdens]. It is an example of what we might today call “a great reset.”

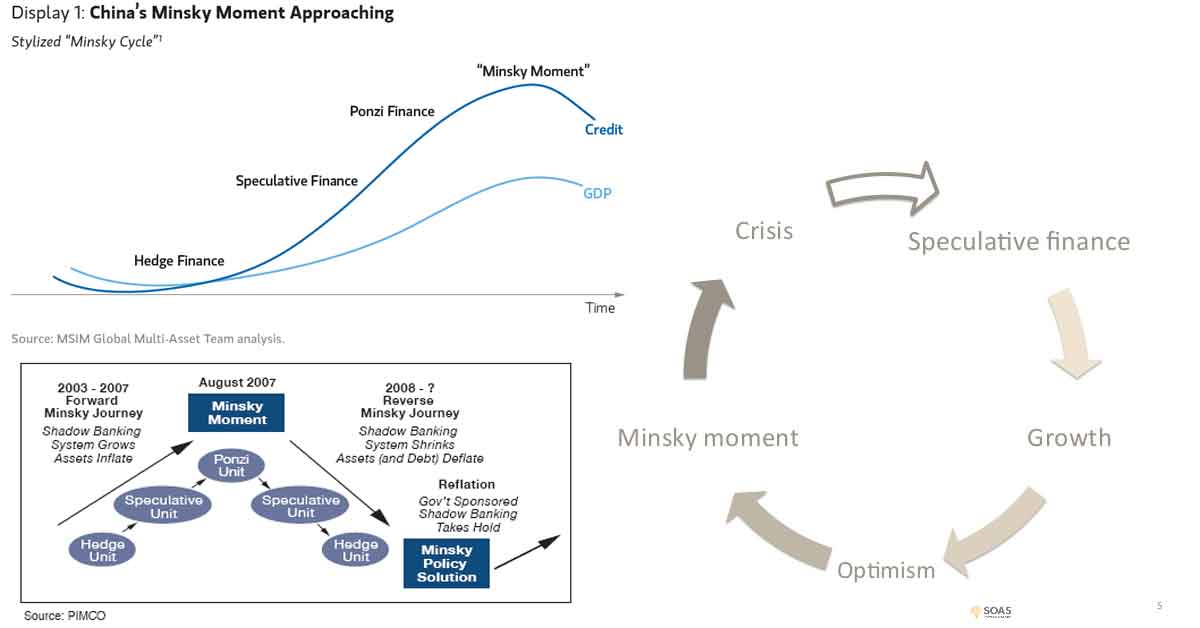

Some claim we are in the middle of an “everything bubble” (an economic bubble, not of an asset, but of everything). We examine this claim and offer opinions.

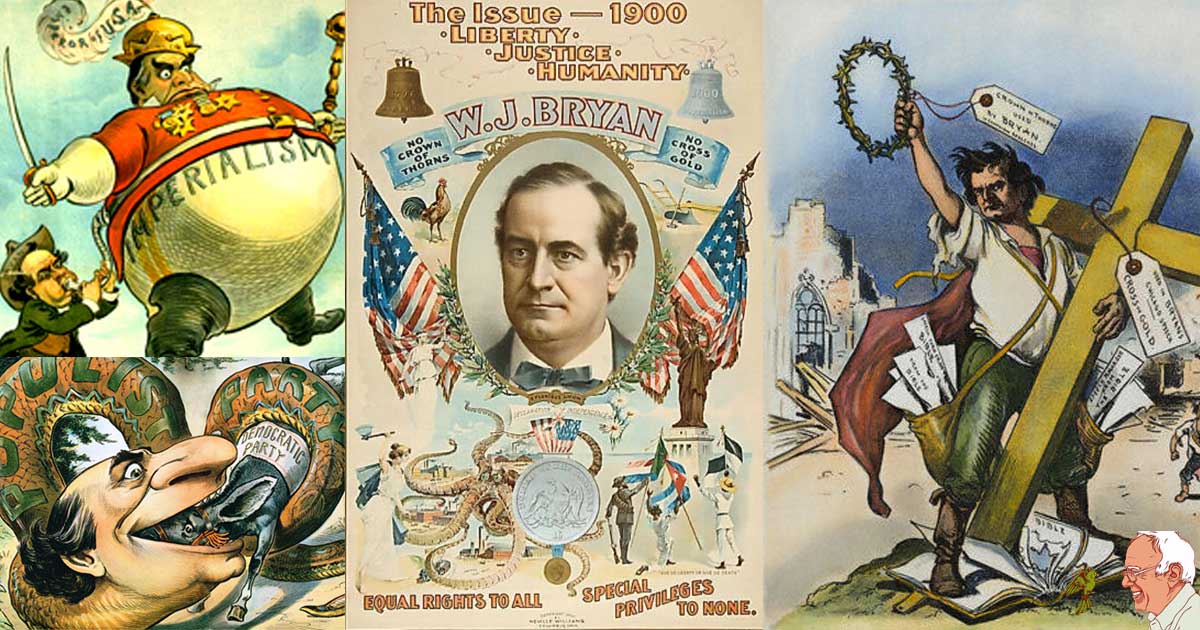

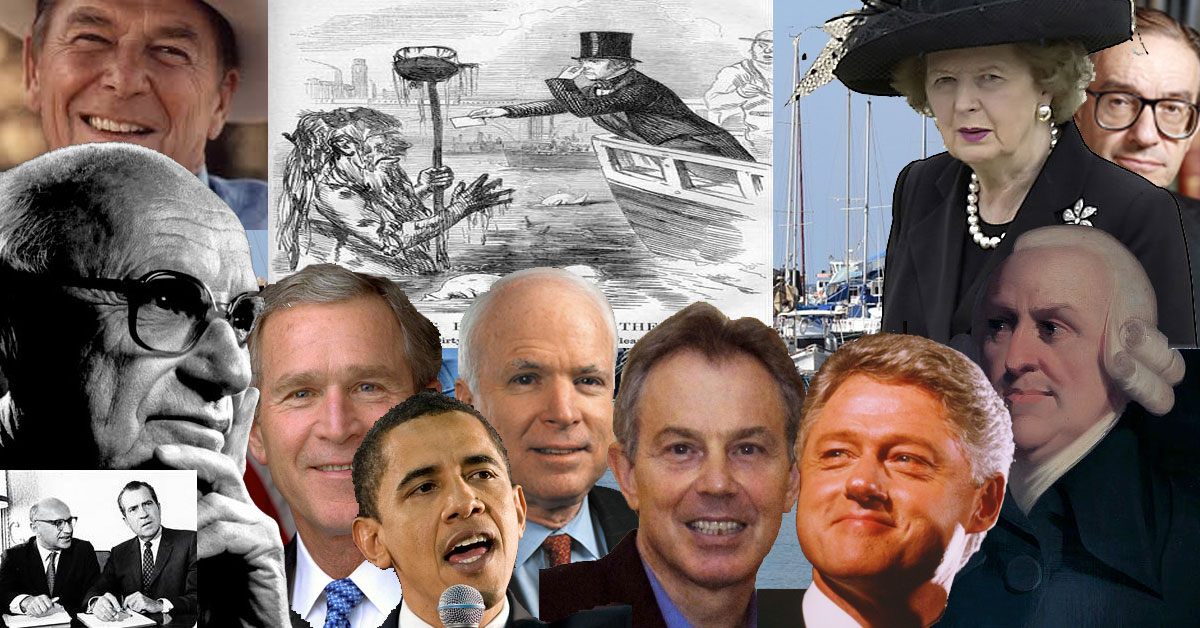

Classical Conservatism is the ideology of authority, hierarchy, order, and tradition (like classical aristocracy). It comes in political and economic forms.

Social liberalism is the ideology of collective liberties and rights that favors social welfare and justice. It comes in a political and economic form.

Neoliberalism is an economically-minded evolution of classical liberalism focused on deregulation, trade, and the private market. It is a “middle way” or “third way” between liberalism and conservatism.

We explain Marx’s conflict theory and other conflict theories to show how tension between social, political, material, and other forces manifest.

We define terms related to “the society of the spectacle” like commodity fetishism, consumerism, “proletarianization,” and alienation.

The Social Safety net is a collection of welfare services meant to help people bounce up when they hit bottom, it is not meant as a net to trap the poor under.

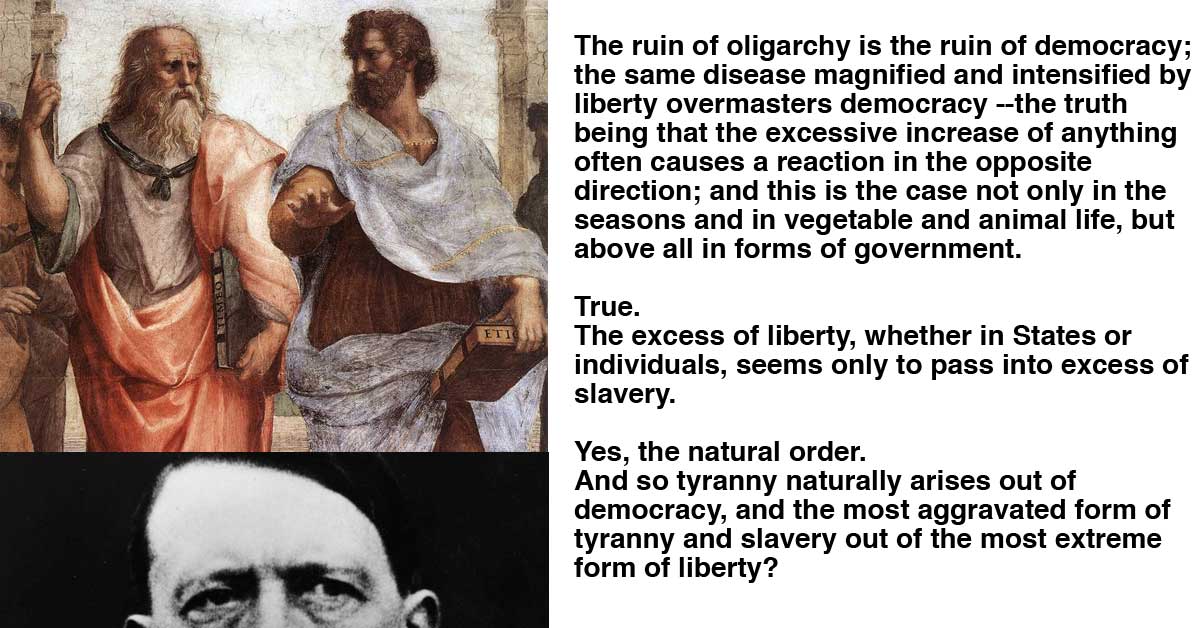

In his Republic, Plato examines how Democracy can lead to Tyranny in a republic. We explain Plato’s theory as it pertains to democracy and tyranny.