The Purpose of the Social Safety Net

Understanding the General Purpose of the Social Safety Net and Welfare State

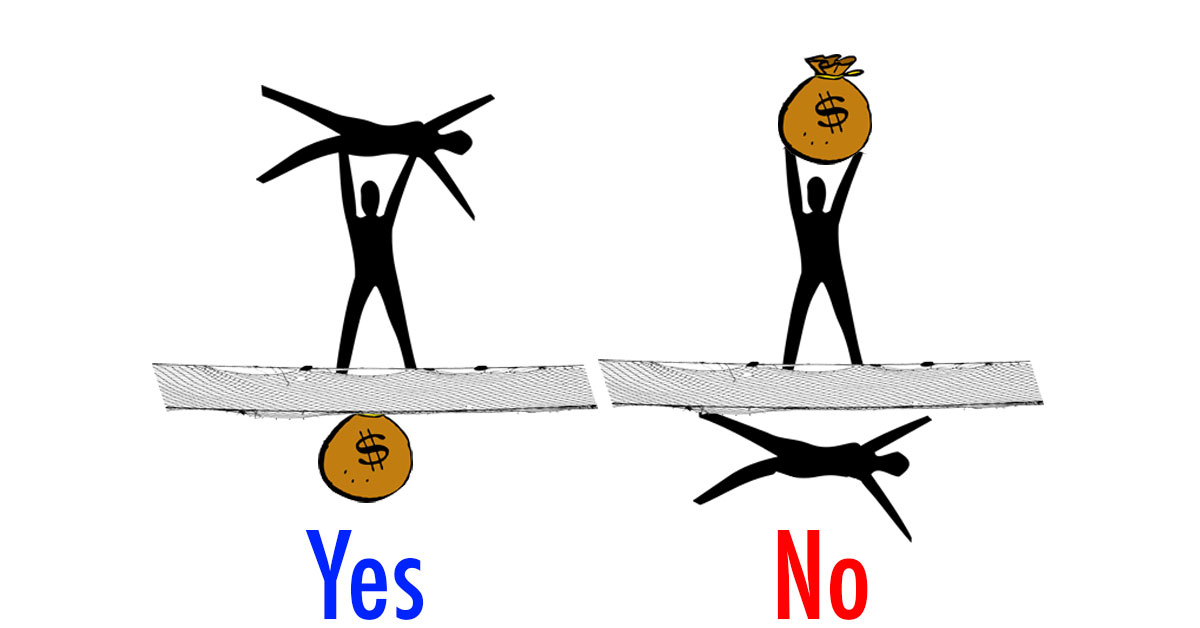

The Social Safety net is a collection of welfare services meant to help people bounce up when they hit bottom, it is not meant as a net to trap the poor under. This “subtle distinction” is one of the keys to moving forward as humanity and preventing the abandonment of the socially liberal state.[1][2]

To the extent that left-wing progressive populists and what today we call “neoliberals” design a safety net that traps people (specifically not only poor, but also lower-middle and middle class, people) to create a welfare class (rather than aiming to bounce the working poor and those in hard times up to the next class) is to the extent that right-wing populists and what today we call “neocons” will rise to power to cut holes in the safety net (thereby diminishing its effects over time).

A net with holes allows some trapped under it to escape, but it does a lackluster job at catching those who are falling and helping them to regain solid footing.

When the net is full of enough holes, and enough people are trapped under it, the people will exclaim “we don’t like this welfare system”.

The welfare system is meant to make things more fair, not to trap the plebs at the bottom of the pyramid. When the plebs trapped at the bottom of the pyramid are left to fight over social issues, while feeling economic oppression both from the free-market and from the state, we have a slippery slope to nowhere forming the foundation… and that creates an inherently unstable structure.

TIP: When the social safety net traps people, one might call it a “welfare trap.”

TIP: To avoid creating a welfare ceiling, one must avoid steep subsidy cliffs. If making $1,000 more means losing $1,200 in tax credits, then it is creates a disincentive to increase one’s taxable income. This is the sort of policy that creates a “a safety net which traps people in poverty” instead of “a safety net which catches those who fall and helps bounce them back up.”

TIP: People tend to consider the income tax only and thus get this idea that a flat tax is more fair, or that taxes like sales tax are more fair than the income tax. The problem with this logic is that about half of Americans don’t pay the income tax due to tax credits. Instead the bottom half pay a disproportionate share of their income to sales tax, excises taxes, and payroll taxes despite having a lower “ability to pay” than higher earners (who, especially at the highest end of earners, enjoy regressive and flat taxes and larger tax breaks). The rich also save more than lower incomes, while lower incomes extend themselves on credit (and then pay interest to the investor and business class). All these factors combined make things much more complex than they might seem on the surface.

Colonial Williamsburg’s Nutshell History: Social Safety Net. At the church you give 10%, when your child is hungry you feed them, life is full of socialism, socialism is natural and unavoidable to all but hermits, the hangup is on how we implement it and how statist the solution is.General Liberal and Conservative Arguments for and Against the Welfare State

Here are some general arguments for and against the welfare state from the liberal and conservative perspective (here we are consider broad and general outward message only, more nuanced implications are covered by each sides argument against the other). [3]

Liberal Arguments For a Robust Safety Net

The argument for the safety net using liberal logic: Liberals generally argue that providing necessary (not luxury) public services to society’s lower classes is 1. moral and 2. smart economically as it helps to lift working families out of poverty while they participate in the economy.

The liberal argument against conservative logic: Liberals generally argue that the conservative focus on individual liberty just creates an oligarchy who can make wage slaves out of the lower classes. If families don’t have access to healthcare and education they are going to end up as unskilled wage workers dependent on corporations. That aside, charity can’t step in every time so there will be more sick and suffering poor.

Social Safety Net.Conservative Arguments For a Limited Safety Net

The argument for conservative logic: Conservatives generally argue that the safety net represents the state getting in the way of individual liberty and the natural free-market economy (thereby gumming up that which the invisible hand could have done better). In other words, not only does it cost those who work hard and don’t need assistance their tax dollars, it creates a cycle of dependency on the state which compounds over time to create a bloated welfare system.

The conservative argument against liberal logic: Conservatives generally argue that the welfare system only creates a bloated state where the state borrows money creating debt and poorly uses the funds to created a bloated government which tries to take on too many roles that are better left to the private market and natural economy.

Milton Friedman – Whats wrong with welfare? Friedman, or to Libertarians “he who can never be wrong,” makes some of the most compelling arguments against welfare. Unlike most, he comes off his smart and not secretly socially conservative and backs up his logic with principles.BOTTOMLINE: Conservatives see the role of the state (regarding the social safety net) as being limited, tax payers shouldn’t fund a safety net, everyone should pay their own way, some will suffer, but that is why we have charities, individuals must protect citizens from Big Government. Liberals see the role of the state (regarding the social safety net) as being robust, tax payers should all pay into programs like social security and Medicare, we should all work together to avoid suffering, charities don’t cut it alone, government must protect its citizens from the oligarchy.

A Centered Argument for a Moderate Safety Net

Using logic and reason we can conclude that it isn’t that 1/2 of society is right and the other wrong (it isn’t that liberals or conservatives are fully right on their own), but rather that the answer lays in the middle.

It is undoubtedly true that people who try to work hard will fall on hard times. The breadwinner of a family might get sick, they might make bad investments, they might buy their home at the wrong time or spend too much on their kid’s college.

Whatever the case, everyone needs a little help once in their life.

The idea of providing a safety net isn’t socialist as much as it is natural. Insurance not mandated by the state arose naturally and is widely accepted by the left and right.

A social insurance paid through taxes is a pretty reasonable thing, we may not always get the formula right (offering too much power to government or too industry), but that doesn’t mean the core concept is wrong.

The social contract of the state denotes the idea that the state is meant to provide for the general welfare. Insurance is a naturally arising system in a capitalist society.

If the government doesn’t provide a net, the private market will, the goal is to provide the least net necessary to bounce people back up and then let the market handle the rest. Or at least, this is theoretically a very democratic and centered solution. Although, the devil is in the details.

Social Policy: Crash Course Government and Politics #49.

Charles

I’m sorry i totally mistrust markets to provide a safety net . Though your criticism aside are valid .

Thomas DeMicheleThe Author

Also a valid argument. Here you aren’t arguing against the intent or usefulness of a safety net, but arguing that you don’t trust the market to provide it.

I tend to think, for all the faults that we see in practice, a mixed market system like we have is the best method. But of course that is just my opinion.