Getting Rid of the Estate Tax Would Increase the Wealth Gap

The estate tax (“death tax”) is one of the taxes preventing an unsustainable wealth gap; eliminating the estate tax would increase the wealth gap.

Economy refers to the production, distribution, trade, and consumption of goods and services.

The estate tax (“death tax”) is one of the taxes preventing an unsustainable wealth gap; eliminating the estate tax would increase the wealth gap.

Generally speaking, a modest increase to the minimum wage will increase household spending and thus stimulate the economy. However, this can be offset by job loss or hour reduction, inflation, and other factors.

According to 2016 data, slot machines account for more revenue than all other casino games combined, and penny slots account for more revenue than any other casino game.

The federal estate tax on property (cash, real estate, stock, or other assets) transferred from deceased persons to their heirs is a fair tax that helps prevent a wealth gap over time.

According to a 2016 Gallup poll about half of American adults own stocks and about half don’t. This is down since 2007 when around 65% of American adults owned stocks.

The United States has the world’s highest incarceration rate and hosts more prison inmates than all other developed nations combined.

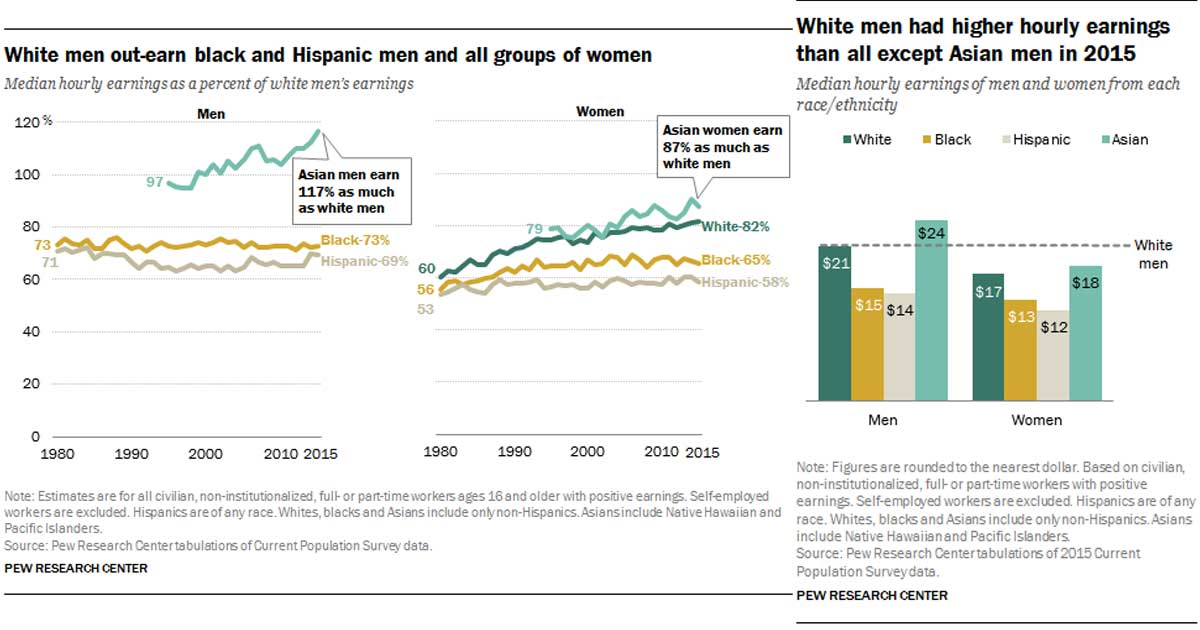

The gender pay gap is real, and so is the gender earnings gap. Even after all reasonable differences are factored out, an unexplained pay gap between men and women exists across the board.

Usury (charging interest in moneylending, especially at high rates) used to be viewed as a sin by many religions and was banned by many cultures.

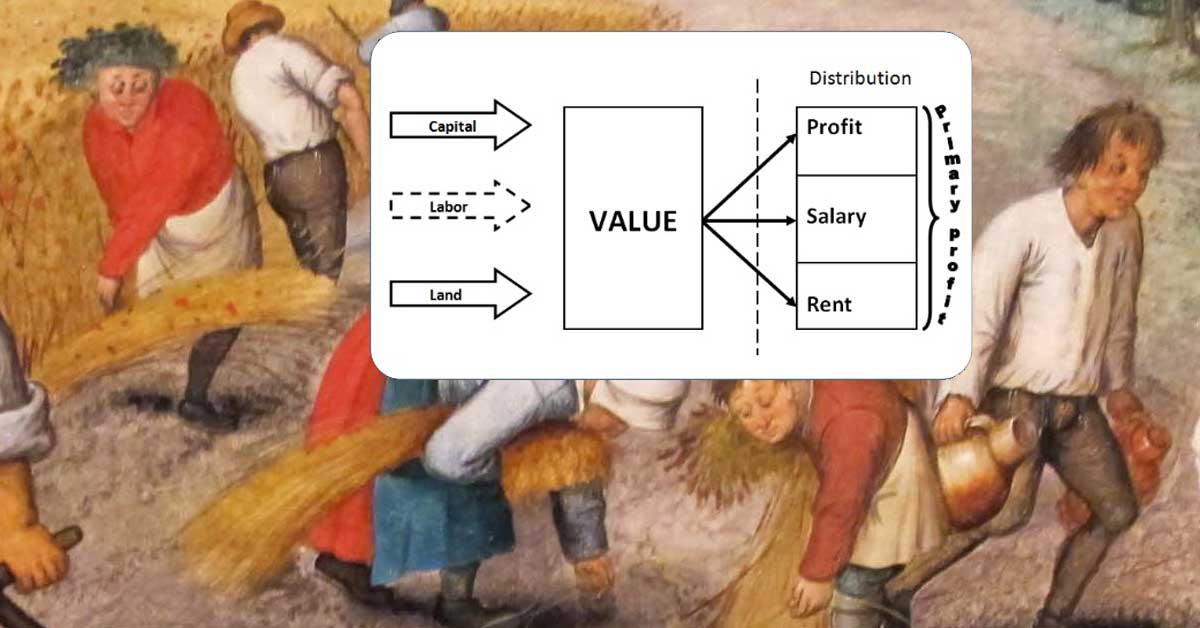

As John Locke and Adam Smith elude, physical work creates private property and gives possessions exchange-value (value in a trade).

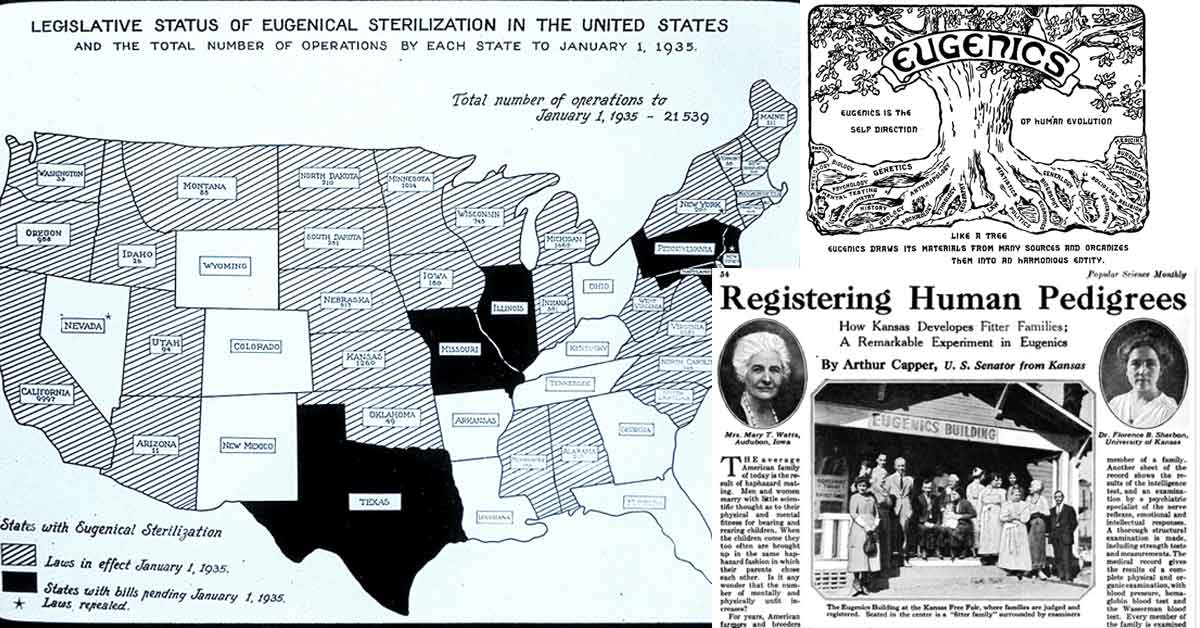

Eugenics (including positive eugenics which breeds traits, and negative eugenics which prevents breeding) has been practiced since the Greeks, but rose to popularity in the west starting in the late 1800’s.