The Top Income Tax Bracket Used to Be 90% or More

The top marginal income tax rate was over 90% under FDR and Eisenhower, but the effective rate in those times ranged from roughly 0% – 60%.

A compulsory contribution to government for facilities or services, typically levied upon income, goods, services, and transactions.

The top marginal income tax rate was over 90% under FDR and Eisenhower, but the effective rate in those times ranged from roughly 0% – 60%.

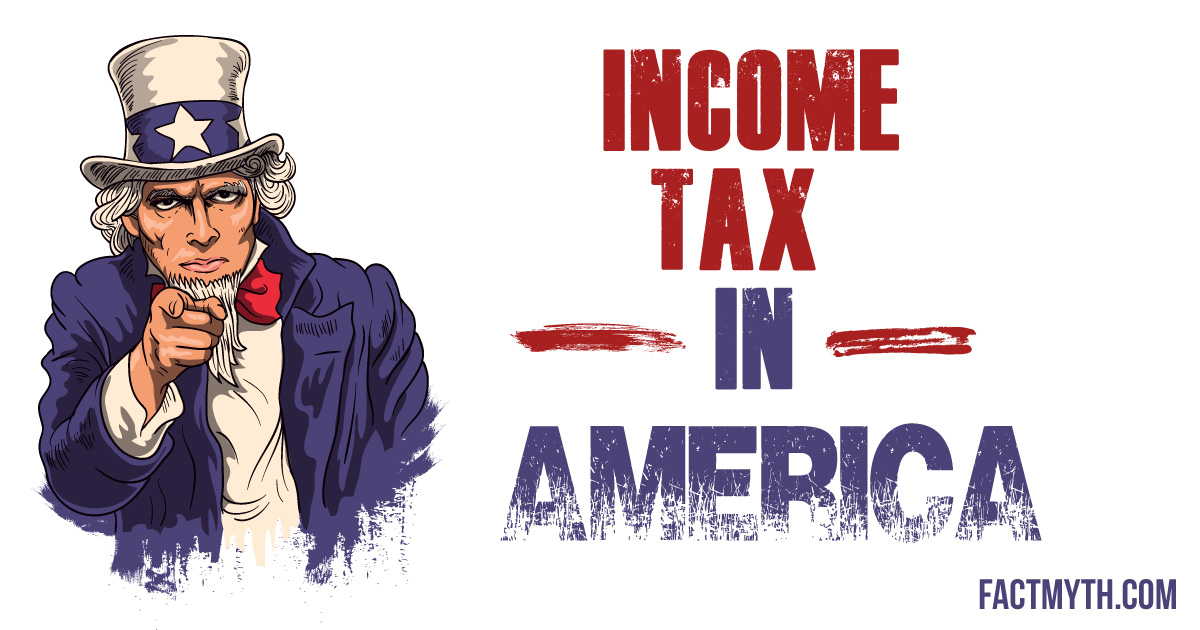

The long term capital gains tax is lower than other federal income taxes, including the capital gains tax and the income tax.

It is a myth that the estate tax hurts poor and middle class Americans, only the richest Americans (0.2% of families) pay the estate tax.

The estate tax (“death tax”) is one of the taxes preventing an unsustainable wealth gap; eliminating the estate tax would increase the wealth gap.

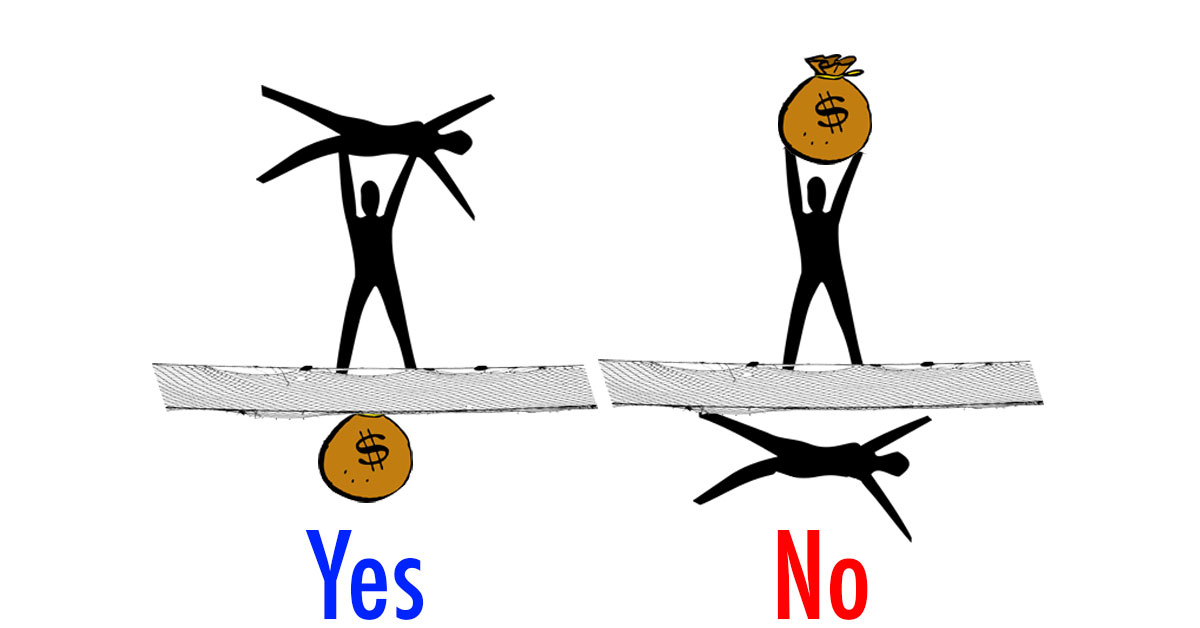

The Social Safety net is a collection of welfare services meant to help people bounce up when they hit bottom, it is not meant as a net to trap the poor under.

Reagan didn’t just say “Government is the problem,” he said, “In this present crisis, government is not the solution to our problem; government is the problem.”

Generally speaking, a modest increase to the minimum wage will increase household spending and thus stimulate the economy. However, this can be offset by job loss or hour reduction, inflation, and other factors.

The federal estate tax on property (cash, real estate, stock, or other assets) transferred from deceased persons to their heirs is a fair tax that helps prevent a wealth gap over time.

According to a 2016 Gallup poll about half of American adults own stocks and about half don’t. This is down since 2007 when around 65% of American adults owned stocks.

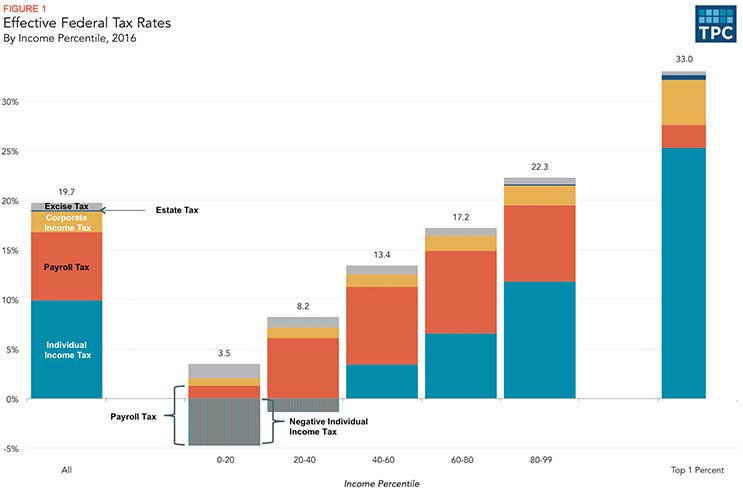

In America we have a Progressive Federal Income Tax system broken down into “tax brackets”. Tax Filers pay the “marginal tax rate” on each dollar of income in a given bracket (after most deductions, but before tax credits).