Long term capital gains are your best friend if you make lots of wealth… but even if you don’t, consider the benefits of capital gains. A little bit of investing every year can mean big benefits over time.

The Long Term Capital Gains Tax is Lower Than the Short Term Capital Gains Tax fact

The Long Term Capital Gains Tax vs. the Short Term Capital Gains Tax (and the Regular Income Tax)

The long term capital gains tax is lower than other federal income taxes, including the capital gains tax and the income tax.[1][2]

A Summary of the Long Term Capital Gains Tax and Its Implications

In other words, if you hold a capital asset (like stocks, bonds, and real estate) for more than 12 calendar months, you pay a lower tax rate on it when you sell it than you do if you keep it less than 12 months or than you do if you claim ordinary income (for example, from labor AKA working).

This is the general rule of thumb, however there are some notes. For one, some states have a long term capital gains tax that differs from the federal one. Meanwhile, there are exemptions from the long term capital gains tax (for example the sale of a primary home is exempted up to $250,000 for an individual $500,000 for a family and gains made in 401ks don’t count).

Below we will address each point made above in more detail in its own section and discuss a few more details and implications of the long term capital gains tax rate.

The logic behind this: It incentivizes investors to keep money in assets (like stocks and bonds) rather than swapping around their funds and day trading to chase short term profits. This helps keep markets stable. An even larger tax break is given for investing in certain types of new companies for more than 5 years. The justification is essentially the same for that reduced long term tax.

The Long Term Capital Gains Tax is About 1/2 the Amount of Other Federal Taxes

In simple terms, the bottom line here is that the long term capital gains tax is about 1/2 of the short term capital gains tax and federal income tax (which are both essentially taxed at the same rate).

TIP: The corporate income tax is a progressive / regressive tax that is also higher than the long term gains tax (meaning shares in companies have more value than income for companies in many respects). Learn more about the corporate tax (as it stands prior to Trump’s budget).

What is the Capital Gains Tax?

A capital gains tax is simply a tax on profits made from selling capital assets (stocks, bonds, real estate, comic books, rare coins, artwork, a company, etc; if the income wasn’t from labor, it is capital gains).

Here we should note that some gains follow special rules, such as “gains on art and collectibles are taxed as ordinary income up to a maximum 28% rate,” but this is the gist.

19. Warren Buffett’s 2nd Rule – Understanding Capital Gains Tax.TIP: A capitalist is someone who makes capital (in the money form) from capital gains.

Short Term Capital Gains Tax vs. Long Term Capital Gains Tax

Capital gains and losses are classified as long term if the asset was held for more than one year, and short term if held for a year or less.

In other words:

- A short-term capital gain is from profit on the sale of an asset you’ve held for one year or less.

- Short-term capital gains are taxed at the same rate as ordinary income.

- A long-term capital gain is from profit on a sale of an asset that you’ve held for more than one year.

- Long-term capital gains are taxed at about half the rate of short term capital gains. Taxpayers in the 10 and 15 percent tax brackets pay no tax on long-term gains on most assets; taxpayers in the 25-, 28-, 33-, or 35- percent income tax brackets face a 15 percent rate on long-term capital gains. For those in the top 39.6 percent bracket for ordinary income, the rate is 20 percent.

- 5-Year Capital gains in specific businesses are a few points lower than regular long term gains.

In other words, if you keep an asset for over a year, you pay 1/2 of the taxes that those who keep an asset for less than a year or those who make their money as income from labor pay.

How capital gains tax works – MoneyWeek Investment Tutorials.TIP: Capital losses may be used to offset capital gains, along with up to $3,000 of other taxable income. The unused portion of a capital loss may be carried over to future years (at $3,000 a year).

TIP: Those with large estates (capital assets and wealth) tend to make a lot of wealth in long term capital gains. This means they never really paid the same tax rate the rest of us did on that wealth. Something to keep in mind about the fairness of the estate tax (the inheritance tax on intergenerational wealth over $5.49 million dollars in 2017 adjusted each year).

Exemptions and Details on Capital Gains

With the above in mind, there are certain details to consider. For example:

- The Net Investment Income Tax, or NIIT, and applies to profits on asset sales; And,

- There is an exemption of $250,000 for capital gains on primary homes.

So there are other costs and tax deductions to consider here, such as gift taxes and the fact that “Individuals may exclude up to 50 percent of capital gains on stock held for more than five years in a domestic C corporation with gross assets under $50 million on the date of the stock’s issuance.” (Or, in plain English: capital gains for stock in specific types of businesses held for over 5 years are taxed at a rate of a few points lower than regular long term gains to incentivize investing in domestic companies).

TIP: The NIIT is an additional 3.8% tax that applies to individuals, estates and trusts with net investment income that exceeds certain thresholds. It was created by the Affordable Care Act, and is likely to be repealed by the Trump administration.

Comparing the Short Term Capital Gains Tax, Long Term Capital Gains Tax, and Federal Income Tax Brackets

The Short Term Capital Gains Tax, Long Term Capital Gains Tax, and Federal Income Tax Brackets can be expressed in the following table from Moneychimp.com (see their handy calculator for more):

TIP: See how the marginal tax rate works, you pay the rate on each dollar over that bracket (not on all dollars once your reach that bracket).

|

||||||||||||||||||||||

TIP: The 5-year gains tax is 8% on the 10% bracket, 18% on the rest.

TIP: Yes indeed, that means the very wealthy pay 20% on their capital gains from owning the factors of production while the worker pays 39.6% on equivalent monies. That isn’t unfair per-say, in fact it provides really important incentives in some markets, but it is none-the-less part of what drives the wealth gap.

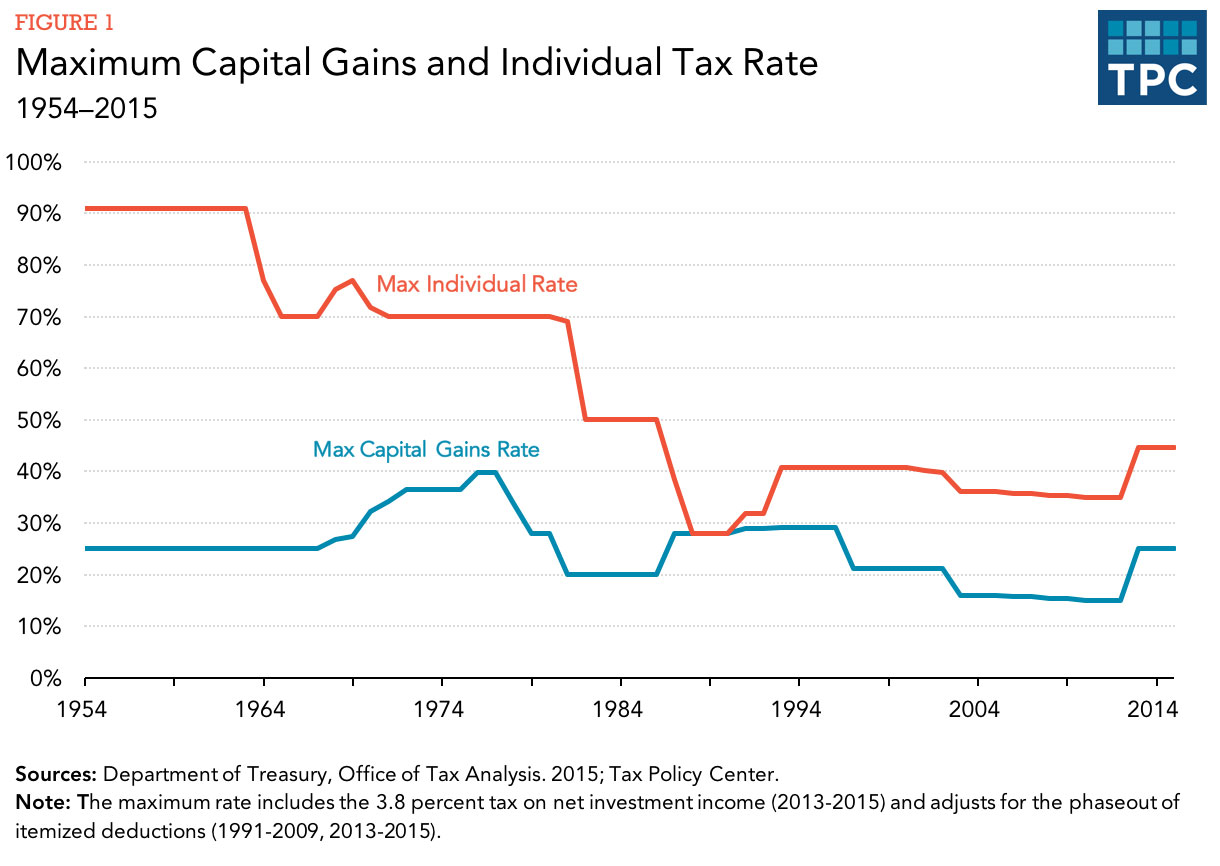

TIP: To that last point, as you can see in the image at the top of the page, rarely does a politician of either party change the capital gains tax. Obama notably increased it by a small amount to cover healthcare, but even FDR’s 90% income tax rate was just that, an income tax on top earners (it was not an increase to the capital gains tax). The greater the difference between the long term capital gains and estate tax (and other wealth taxes) and the ordinary income and short term capital gains tax, the quicker the wealth gap will generally increase. This doesn’t suggest one party over the other, as counting all taxes that concept is much more complex to explain, it just suggests that the capital gains rate hasn’t changed much over time, while the income tax has.