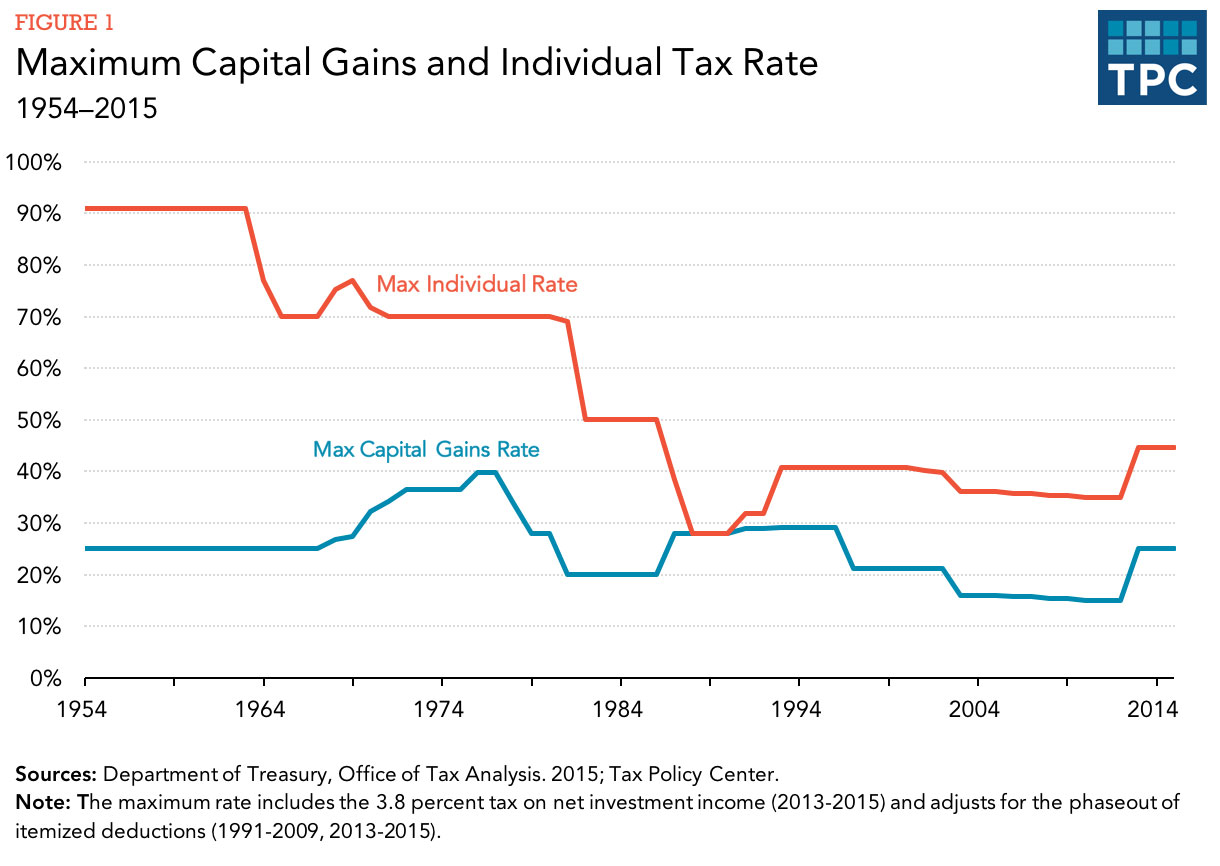

The Top Income Tax Bracket Used to Be 90% or More

The top marginal income tax rate was over 90% under FDR and Eisenhower, but the effective rate in those times ranged from roughly 0% – 60%.

Society and Social Sciences is a broad category referring to the relationships between networks and groups of people, and the study of this.

The top marginal income tax rate was over 90% under FDR and Eisenhower, but the effective rate in those times ranged from roughly 0% – 60%.

We explain Marx’s conflict theory and other conflict theories to show how tension between social, political, material, and other forces manifest.

We define terms related to “the society of the spectacle” like commodity fetishism, consumerism, “proletarianization,” and alienation.

We present a list of types of propaganda, propaganda techniques, and propaganda strategies used to manipulate public opinion in the modern day.

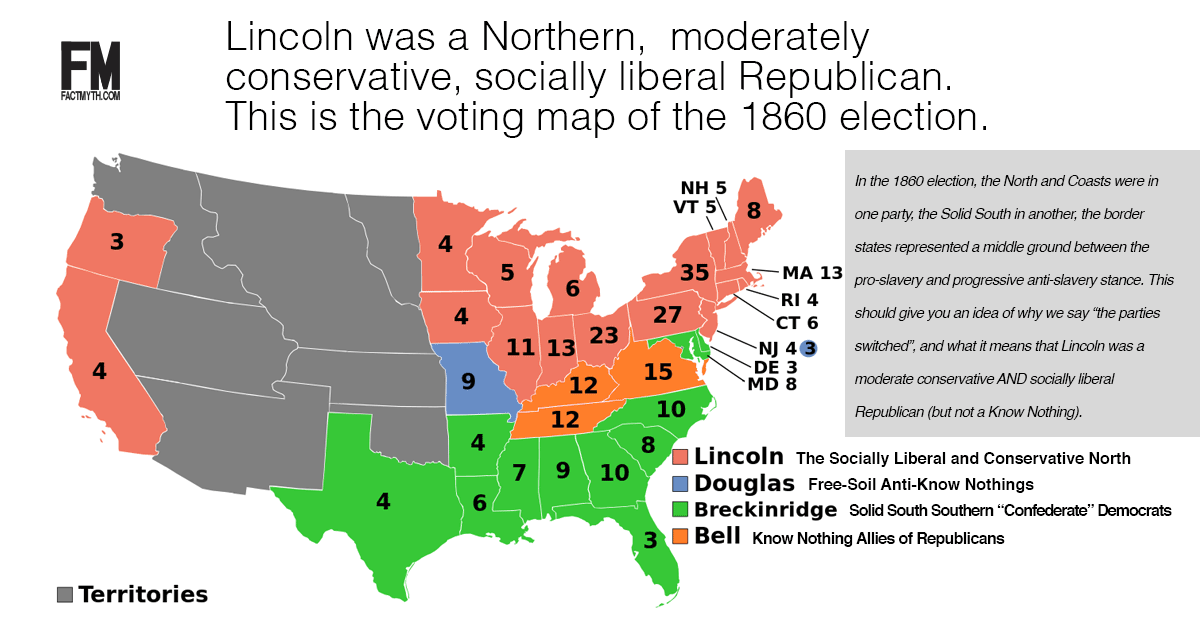

The factions of the third party system are indicative of the actual factions in American history that comprise the “big tent” political parties of any era.

Some claim there was a “one-party system” for a brief moment in the Era of Good Feelings under Monroe and the Democratic-Republicans, but that isn’t fully true. There was still federalist opposition in those years.

The long term capital gains tax is lower than other federal income taxes, including the capital gains tax and the income tax.

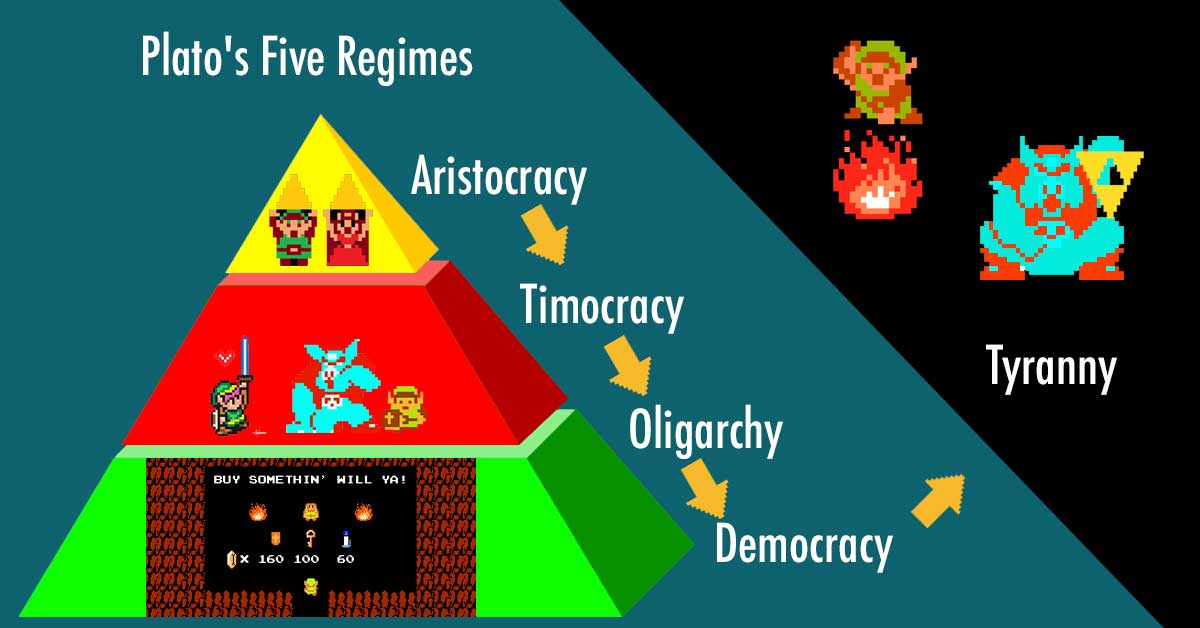

There is a type of tyranny for at least every type of government. When special interests are favored over the general will and the rule of the law, it is a type of tyranny.

Democracy is a form of government where power originates with the citizens, the citizens then either rule directly or delegate power to representatives.

Oligarchy is a classical form of government ruled “by the few.” Generally, the term implies that monied interests rule (dictate the laws) rather than the people or their representatives.