The Dutch East India Company Was the First Publicly Traded Company fact

What was the First Company to Issue Stock?

In 1602, the Dutch East India Company (VOC) became the first publicly traded company when it sold shares on its own Amsterdam Stock Exchange (the first stock market).[1][2][3][4][5]

While the Dutch East India Company was the first modern company to issue stock to the public, and the first to create a modern public stock exchange, they weren’t the first entity to issue stock in general (see the birth of banking).

Early forms of stocks and markets had been being used since at least the 1100’s, if not before (and so had the closely related Marine Insurance), and then evolved in coffee shops were the first stocks were sold in private little “markets” in places like Florence (and other Italian cities).

Despite these early markets, the first public modern market begins with the story of the VOC and the rival East India Companies.

Below we tell the history of the early stock markets and explain why the story of modern markets starts with the East India Companies and the spice trade.

History of the Stock Market.TIP: The story of stocks is similar to the story of insurance, as both are naturally occurring systems that arise out of the need to mitigate risk related to trade.[6]

A Quick History of the East India Companies

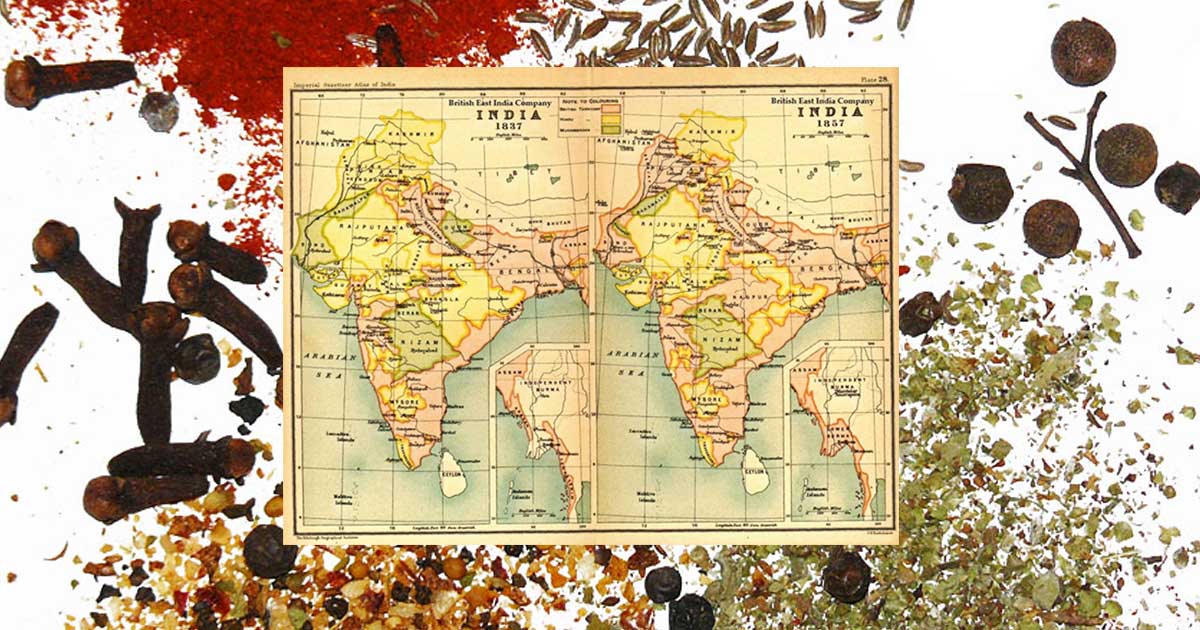

The Dutch East India Company was technically called by its Dutch name Verenigde Oostindische Compagnie, or “VOC.” The British called it the Dutch East India Company. Confusingly, the British had created their own initially less successful East India Company before the Dutch in 1600. The Portuguese had previously dominated the East India spice trade before the early 1600’s.

Before the creation of the East India Companies, it was customary to create a company for a single voyage and then dismantle it. The English were the first to create a permanent East India Company in 1600, an early monopoly. The Dutch quickly one-upped the British by offering stock in the company to the public, which made their company take off quickly. Both companies are examples of early multinational corporations and state-backed “cronyist “monopolies that mix private and public interests.

The Dutch East India Company became the first public company to issue stock due, in part, to a high risk of pirates (other factors like shipwrecks and fluctuations in the market also made it sensible move). The pirates weren’t just rogue bands of scallywags; they were often hired by rival Portuguese, English, and Dutch concerns to plunder the other nation’s ships. The three nations warred often.

Details aside, the first publicly traded stocks were essentially a form of pirate insurance.

TIP: The Dutch East India Company was formed in 1602 by a royal charter by the Dutch government granting a 21-year monopoly on trade with the East Indies and sovereign rights in any newly discovered territories. It continued to extend this charter via bribery (hence the above statement about cronyism). It also played an integral role in modern history’s first major market crash the South Sea Bubble of 1720. On the plus side, it also helped to create modern Western democracy by ensuring power in Europe and America.[7][8]

The First Stocks and Stock Markets

As noted above the VOC is the first modern publicly traded company, but not the first instance of the use of stocks.

Early versions of stocks had been sold since the 1100’s in France, and early stock markets existed in the 1200’s around Italy and in more proper forms in the 1400’s and 1500s in the Netherlands. All of these early forms of markets either didn’t issue shares or didn’t publicly issue shares. It wasn’t until the Dutch East India Company started selling shares on the Amsterdam exchange it created that publicly traded stocks were born.

Although it is usually considered to be the first stock market, Fernand Braudel argues that this is not precisely true:

Gresham and Defoe (underwriters): The Origins of London Marine Insurance – Dr. Adrian Leonard. Roman insurance aside. The first insurance, marine insurance, was at the same time (14th century Italy) for the same reason (the dangers of sailing, including pirates).“It is not quite accurate to call [Amsterdam] the first stock market, as people often do. State loan stocks had been negotiable at a very early date in Venice, in Florence before 1328, and in Genoa, where there was an active market in the luoghi and paghe of Casa di San Giorgio, not to mention the Kuxen shares in the German mines which were quoted as early as the fifteenth century at the Leipzig fairs, the Spanish juros, the French rentes sur l’Hotel de Ville (municipal stocks) (1522) or the stock market in the Hanseatic towns from the fifteenth century. The statutes of Verona in 1318 confirm the existence of the settlement or forward market … In 1428, the jurist Bartolomeo de Bosco protested against the sale of forward loca in Genoa. All evidence points to the Mediterranean as the cradle of the stock market. But what was new in Amsterdam was the volume, the fluidity of the market and publicity it received, and the speculative freedom of transactions.”

— Fernand Braudel (1983)

Why Did the East India Company Issue Public Stock?

The spice trade, which the Dutch-owned Dutch East India Company had a monopoly in, was a dangerous business. A single ship had about a 30% chance of making its voyage without getting sunk or robbed by pirates. Considerable profits were made every time a ship arrived safe and sound. Stocks were a type of insurance. They allowed people to pool money and buy into several ships rather than putting all their proverbial eggs in one basket. If 1 of 3 ships made it, everyone would make a profit.

Thus, the modern publicly traded IPO was born by businessmen working together to ward off the risk of pirates.[9]

I would say the world never looked back, but it has looked back when discussing things like monopolies and the South Sea Bubble.

Capitalism and the Dutch East India Company: Crash Course World History 229.TIP: An initial public offering (IPO) describes the first time that the stock of a private company is offered to the public. When the East India Company offered its stock publicly for the first time it became the first IPO.

TIP: The British East India Company was the one that was involved in the Boston Tea Party. The East India Companies and the related European dominated trade drove industry in Europe and America from the 1600’s on. Trade companies like this can be seen as one of the roots of western liberalism, and thus a precursor to global neoliberalism and international banking and corporations. Given this, people tend to have strong views on the matter. While trade and pirates both have merit, America the superpower was mostly built on trade and thus this story holds a variety of important lessons.