The 2007 – 2009 Financial Crisis Explained

What Caused the Financial Crisis and Great Recession of 2007 – 2009?

The Story of Economic Collapse: From Deregulation, to Subprime Lending, to Securities Speculation, to the Housing Bubble, to the Big Short, to the Global Recession Explained

We explain the Financial Crisis / Great Recession of 2007 – 2009 that began with the 2006 housing bubble, led to a recession in the U.S. by December 2007, and became a global crisis by 2009.[1][2][3]

Although the recession officially can be said to end by June 2009, impacts of the crisis were felt into the 2010s globally (even contributing to to the sovereign debt crises that erupted in Greece and Ireland in 2010). That makes the Great Recession of 2007 – 2009 the longest recession since World War II and perhaps the most server since the Great Depression.

We explore the complex story of the Financial Crisis and Great Recession of 2007 – 2009 below to find out how deregulation, speculation, and subprime lending in the U.S. led to a bubble and bust that shook the world’s markets.

TIP: The collapse wasn’t the first of its kind. There was the S&L (Savings and Loan) crisis in the Reagan era (at the time called the worst since the Great Depression). The story is eerily similar. The lessons we should have learned but didn’t, “Greed can be good, but only in moderation” and “over regulation isn’t usually good, but neither is too much deregulation”.

The 2008 Financial Crisis: Crash Course Economics #12A Summary of What Caused the Financial Crisis

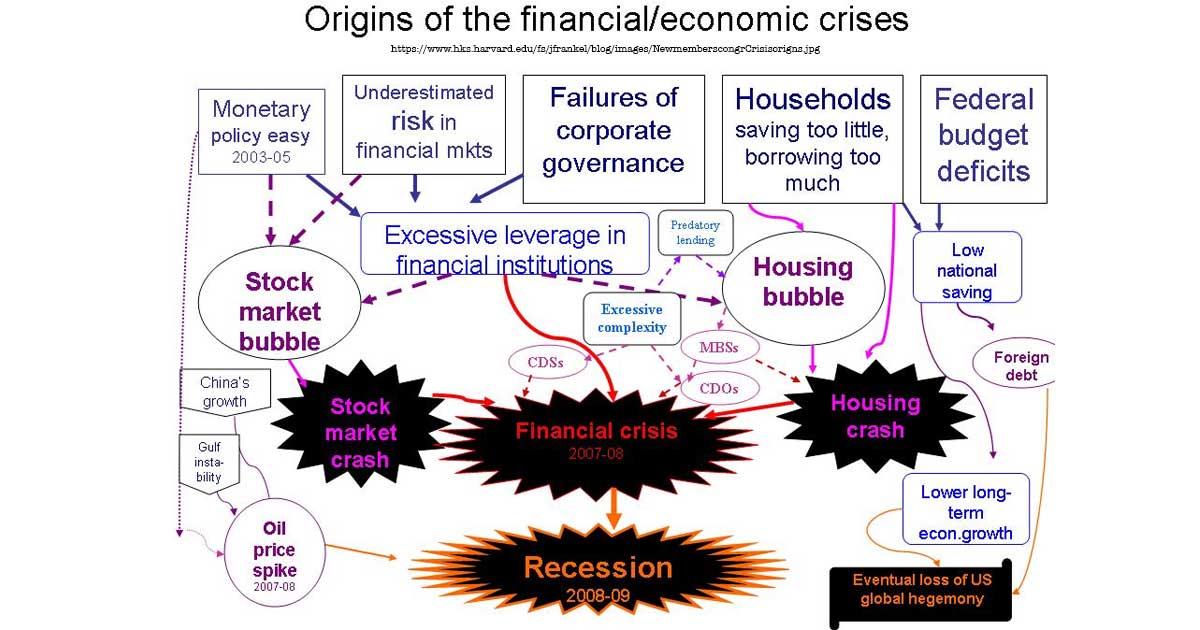

The financial crisis was caused by a number of factors. However, in simple terms we can say, the crisis was caused by banks being incentivized by deregulation to make risky home loans, which were then repackaged as overvalued and overrated assets, which were then speculated on by banks and investors causing “a speculative bubble”.[4][5][6][7][8][9]

In slightly more complete terms, I would offer this overview of the financial crisis:

Deregulation in the 1990s and 2000s including, but was in no way limited to, 1. the repeal of key banking related provisions of Glass-Steagall in 1999 (which allowed depository banks to offer securities and insurance products), and 2. legislative changes in the Community Reinvestment Act (which removed restrictions on lending) led to new securities products like mortgage-backed securities (MBS), credit default swaps (CDs), and collateralized debt obligations (CDOs).

These changes also led to the “subprime lending” of risky home loans by banks backed by government institutions like Freddie Mac and Fannie Mae (which provided liquidity to banks by buying mortgages as a type of insurance).

Collateralized securities combined with a related and corresponding housing boom caused by over inflation of housing prices.

This inflation of prices led to the Housing Bubble of 2006. Then subprime mortgages, which were risky loans made during the boom phase of the bubble, began defaulting in 2007 when the bubble popped as adjustable rates kicked in and raised loan interest rates while housing prices fell.

People stopped making payments as the value of their homes fell, and they could no longer take out loans against what they had assumed to be the ever increasing value of their real estate.

On top of all this, banks were acting as both lenders and speculators (due to deregulation that allowed depository banks and investment banks to merge) and so they got caught in the middle of the worst parts of the mortgage and lending bubble, the defaults, and the depreciating speculative securities (hence the bubble in bank stocks around 2007 – 2009 and the subsequent bailouts).

As banks stocks, securities, and housing prices fell, and as people started defaulting on payments, a recession began in the U.S. by 2008.

Finally, a fully global crisis occurred by 2008 – 2009 as other markets were impacted as an ancillary effect into 2010.

This series of events caused most major US indexes to fall back close to where they were after the 2000 tech bubble, as you can see on the NASDAQ chart below from our page on “the everything bubble.”

The point being, a bubble of the magnitude of the Housing Bubble can be systemic… also notable is that any gains from 2000 – 2008 were mostly wiped out for everyone other than those who shorted the bubble or took profits on the way up. Now consider, national debt was $5.674 trillion in 2000 and $13.562 trillion by 2010.

TLDR; Normal people with retirement accounts and mortgages across the world got taken to the cleaners and ended up with debt (national and private), while speculators and banks either got rich or went broke….due in no small part to an era of excessive deregulation in the banking and housing industry, paired with state money, that led to a speculative bubble (housing / banking bubble of 2006), then financial collapse (financial crisis of 2007 – 2009), then tax payer funded bailout.

Yaron Answers: Glass-Steagall And The Financial Crisis. It all starts with the repeal of the banking provisions of 1933’s Glass-Steagall act, and then it gets as complex as your understanding of global finance and politics. This isn’t a story of villains; this is a story of economic theories butting heads in the very new world economy.TIP: There is now a new Federal Reserve policy including, but not limited to, Dodd-Frank, the Basel III Liquidity Coverage Ratio and Capital Standards, and new rules for money market accounts. These have addressed some of the core problems surrounding the repealing of restrictions like Glass-Steagall. NOTE: Parts of Dodd-Frank were updated in 2018.

It’s not just “the repealing of key banking related provisions in the Glass-Stegall by Gramm–Leach–Bliley. Before moving on, it is important to clarify that, in general, it is deregulation, not the repeal of specific Glass-Stegall provisions, that hastened the collapse and caused risky behavior by some private and public institutions, which in turn caused the recession. Blaming everything on the banking provisions of Glass-Stegall that were repealed is overly simple. It is related, but is just one domino in a much larger picture. When people who understand the full picture say “Glass-Stegall” they are essentially using it as a placeholder for “deregulation in the financial sector over decades, which led to new speculative investment products and practices”.

Dodd-Frank, Glass-Steagall & Wall Street. Dodd-Frank is the “mixed-market” solution to the Crisis (just so it’s clear there is some forward momentum here). Dodd-Frank is also highly contested by some economists and politicians. See The 5 Best and 5 Worst Regulations in Dodd-Frank. The problem with reform is that we are talking about reforms for the biggest business in the world loosely speaking, that business being the American economy as it relates to banking.How Glass-Steagall is Related to the Subprime Lending Crisis and 2006 Housing Bubble

Many public and private factors impacted the crisis, including earlier deregulation regarding lending and banking practices as noted above.

One primary catalyst to the collapse was the repeal of key banking related provisions in 1933’s Glass-Steagall via 1999’s Gramm–Leach–Bliley Act. This allowed depository banks to offer securities and insurance products and created an incentive to speculate and take risks with subprime mortgages.

In simple terms, the deregulation (which was in the works for a while) allowed investment and depository banks to merge and the new environment incentivized risky home loans and speculation on those loans.

Two other key factors were government backing those bad loans via policy allowed for by changes to the Community Reinvestment Act under Clinton and Bush and government backing risky loans via Freddie and Fannie (trying to ensure a booming economy and more people in houses). Also, as an effect, on the ground level, a large part of the problem was simply people (both salespeople driven by commission, with the hierarchy each contributing or turning a blind eye, and consumers, driven to consume beyond their means by too-good-to-be-true deals).

In all cases, if we put bad intentions aside, we can view this as “a cluster of short-sighted good intensions and opportunism gone awry” in an environment of deregulation and gray areas. This statement covers securities rating companies who turned a blind eye, CEO’s pushing sales and NINA loans who turned a blind eye, sales-people high on commissions turning who turned a blind eye, borrowers high on too-good-to-be-true loans who turned a blind eye, etc.

TIP: Ultimately there was no single cause of the crisis. It was a result of many short-sighted and optimistic collective self interests. There was interest in getting homes, putting people in homes, inflating the economy, pleasing investors, making commissions, and selling products. The crisis was also driven by people providing AAA ratings to securities containing troubled assets in order to keep business and save face, providing stimulus to stave off a worse crisis, etc. However, deregulation, speculative trading, loose standards for loans, and government provided insurance for banks, which incentivized more risky behavior for lenders and borrowers are often cited as interrelated primary factors in the recession.

The Crisis of Credit Visualized – [HD] ~ Animated Short Film. This video does a good job of explaining the basics mechanics behind the crisis.A Simplified Example of the Causes of the Financial Crisis.

A simple example of what caused the financial crisis works like this:

Deregulation leads to depository banks and investment banks merging. These banks are now incentivized by external and internal policy to make more and more home loans. They are also able to create more speculative financial instruments to speculate on those loans. This causes a housing market boom as loans are doled out while demand for housing rises.

At the height of the 2006 housing bubble, Joe is given a home loan for $100,000 despite not having a job or good credit. Jane, the salesperson, happily take her commission which pleases management, which pleases stockholders, and all this pleases the politicians who care about markets and people.

The bank trades this soon-to-be bad debt as though it was worth $100,000 plus thirty years of interest via different financial products. This included products made by dividing Joe’s bad loan into slices and packaging it with slices of good loans in various salable shares designed for different types of investors.

The pyramid of investments based on ever-increasing home values fell when the housing bubble burst. Joe never paid back his loan on his house, which was now worth less than he owes, and the housing market crashed.

Instead of having valuable real estate, the bank had a foreclosed home worth much less than $100,000. The financial products based on that loan were worth pennies on the dollar.

Those holding the hot-potato lose fortunes. Those who shorted the market prosper. A taxpayer-funded bailout ensues to save the Big Banks and stave off a full-blown depression. Instead, we see a global recession as shareholders and other markets are hit with a domino effect worldwide.

Below we tell the story of the crisis and its many causes and effects in as simple terms as possible, see the explainer videos and links below for more details!

TIP: In many ways, this is a mirror image of the 2016 Wells Fargo “cross-selling” scandal. When commissions and loose regulations incentivize the ground level to skirt ethics in favor of short-term profits, and management and regulators turn a blind eye to please investors, it causes a bubble based on nothing but air, and thus (according to physics itself) the bubble must pop.

Understanding The Financial Crisis–For Kids and Grownups.How the Housing Bubble Led to the Collapse

Lastly, before we move onto some terms and thoughts, let’s focus in on the housing bubble aspect of the collapse.

As noted above, the events leading up to the financial crisis revolved around subprime lending (making bad loans) and speculation on the financial products that made up of these loans (mortgage-backed securities). The events surrounding the subprime mortgage crisis contributed to the United States housing bubble which started in 2004 and began to decline in 2006 and eventually became the start of the 2007 – 2009 financial crisis.

Shortly after the height of the housing bubble, people’s interest rates went up as adjustable rates were one of the provisions of subprime mortgages. Many who held subprime mortgages stopped paying them as the value of their assets depreciated. They defaulted on their loans, sending their homes into foreclosure and leaving the bank with a now undervalued home rather than overvalued payments which included expected interest over time.

The markets didn’t collapse right away. Rating agencies kept the bubble artificially inflated by overrating troubled assets. Eventually, however, the truth came out, and the troubled assets were exposed. The banks then stopped lending to people and other banks. The rapid stream of defaults, mixed with the freeze on loans, collapsed the financial products that contained the troubled assets and even some of institutions that held the assets.

The result was a domino effect throughout the U.S. and the world as many other countries held the securities.

Warren Buffett on The Housing Bubble ,Real Estate Longevity and the Values of Berkshire Hathaway. Buffet is discussing the housing bubble and other asset bubbles. When we consider that even Buffett didn’t see this coming, it reminds us how easy it is to get caught up in euphoria.TIP: The chart below shows one bit of the puzzle, the rapid inflation of home prices spurred on by the new mortgage-backed securities which had become a profitable product for banks.

![Fig. 1: Robert Shiller's plot of U.S. home prices, population, building costs, and bond yields, from Irrational Exuberance, 2nd ed.[1] Shiller shows that inflation-adjusted U.S. home prices increased 0.4% per year from 1890 to 2004 and 0.7% per year from 1940 to 2004, whereas U.S. census data from 1940 to 2004 shows that the self-assessed value increased 2% per year (source).](http://media.factmyth.com/2016/09/inflation-adjusted-home-prices-1890-2005.jpg)

Robert Shiller’s plot of U.S. home prices, population, building costs, and bond yields, from Irrational Exuberance, 2nd ed.(source).

The Consequences

The series of events which we have now looked at through a few different “frames of reference,” caused the bottom drop out, the bubble to pop, and the U.S. and then global market to crash starting in late 2007 and ending in 2009.

Consequently, the value of homes and assets related to the mortgages, and the value of the banks holding the mortgages, dropped as well.

This negative feedback loop was fed by chaos in the markets, a bailout to stabilize the economy consisting of TARP, troubled assets relief program and other stimulus, big losses for those left holding the troubled assets, and no bailout money.

Why the U.S. Government Bought ‘Troubled Assets’.FACT: The great recession of 2008 and worldwide economic crisis was the worst financial crisis since the Great Depression by many measures.

Understanding Subprime Lending, Loans, and Borrowing

To understand the crisis we have to back up out of summary mode and take a look at a few specific factors: Subprime lending, Deregulation in the 90’s and 2000’s, and the types of financial products involved in the crisis including mortgage-backed securities.

Let’s cover subprime lending first.

What does subprime lending mean?

Subprime lending is a polite way to say “making loans to people who may have difficulty maintaining a repayment schedule” or, in the early-to-mid 2000’s, making loans with a near zero chance of being paid back exclusively for short-term gain.

So a subprime loan is “a risky or even bad loan,” and subprime lending is “making bad or risky loans.”

TIP: Historically, subprime borrowers were defined as having FICO scores below 640, although this has varied over time and circumstances. In this crisis, subprime meant predatory lending, creating mortgage packages that were designed to be sold, rather than solid loans that were expected to ensure repayment.

Why make subprime loans? Why trade financial products made from them?

Mortgage salespeople get a commission, governments want people in houses and markets going up, bankers get a commission when they make loans and trades and get cash-on-hand when they sell loan-based products to investors, people want homes, and not everyone understands how interest and adjustable rate mortgages work.

Short-sighted greed on behalf of the private and public markets, banks, and people caused the crisis. There are no real heroes or villains in this story, although predatory lending and deregulation are more serious problem than Joe-the-citizen taking a too-good-to-be-true deal.

In retrospect, it seems very few people realized what was happening. Everyone was focused on building homes, selling homes, buying homes, making commissions, and “keeping the party going.”

Good Explanation of the Subprime Mortgage Crisis.The Financial Crisis in More Detail

Subprime lending is easy to grasp, but just as important is the deregulation of banks and the financial products at the heart of the Crisis.

Understanding the Deregulation and Financial Products

In the 90’s new financial products were invented. These included Credit Default Swaps “CDS” where the buyer of the CDS makes a series of payments to the seller and, in exchange, receives a payoff if the loan defaults, which is a type of “swap.” For the first time bundled mortgages were sold. These mortgages bundles were sold to mitigate risk and meet the needs of different investors. Ideally, some loan holders pay, and there is net profit. That is the original purpose of stock that was being created.

Credit default swaps (CDS) – What are they and should investors be worried about them?Starting in the early 2000’s both good and bad (or “subprime”) mortgages began being packaged together by newly deregulated banks to mitigate risk.

This was allowed for by the 1999 Financial Services Modernization Act (the Gramm–Leach–Bliley Act) which repealed Glass-Steagall. When Glass-Steagall was repealed, insurance companies, investment banks or speculators, and depositary banks, where people keep their money, could merge. The bankers, who were creators of the mortgages that were packaged and sold, became speculators, which eventually caused the crisis. As Wikipedia puts it, it removed barriers in the market among banking companies, securities companies, and insurance companies that prohibited any one institution from acting as any combination of an investment bank, a commercial bank, and an insurance company.

Subprime Lending and Mortgage-Backed Securities

Over time, in this new post-Modernization Act era, some, but not ALL banks began acting as insurers, investment banks, and commercial depository banks and started doing two things that contributed to the financial crisis:

- As lenders, they started giving out home loans to people who could not realistically pay them back. People with little cash on hand, low FICA scores, and no jobs were offered adjustable-rate mortgages that were cheap at first, and then readjusted to higher rates later. This was done because there are only so many “sound” mortgages, but there was an unending need to create financial products.

- They started pooling and repackaging these bad loans into “tranche” products including mortgage-backed securities (MBS) and collateralized debt obligations (CDO). This is where you take a single mortgage and cut it into slices and put some of it in package A, some in B, some in C, etc. This was driven by the novel possibility of loaning money to someone for a mortgage, bundling it with other mortgages, and then selling the loans. Money was being made on selling mortgages, not on making sound loans that were repaid over time.

TIP: They began giving riskier and risker loans since the money was in selling loans, not being repaid for them. This created riskier and riskier products. It got so extreme that it went beyond “risk.” Some CDOs became “ticking time bombs” of certain failure. Once the housing bubble had burst, subprime mortgage defaults were inventible, and many CDOs were full of “slices” of subprime loans.

The direct actions of the banks aside, there were other players who contributed to the growing crisis:

Rating agencies who were supposed to rate financial products accurately rated these near worthless products filled with “ticking adjustable rate time bombs” as “AAA” (meaning very low risk as a bond should be). Thus foreign and domestic investors thought they were investing in “AAA” products but they were really investing in packages that included B-level or high risk loans that had little chance of ever paying out and were about as sound as penny stocks or snake oil.

Also, regulators who were supposed to be checking and balancing the institutions, or at least checking the banks did neither. Some rogue regulators and bankers stood up, but most people thought this was a great way to make money.

The government contributed to the crisis. It created padding for both lenders and borrowers by way of subsidization and Freddie and Fannie buying bad loans. This government-cushioned risk led to higher risk taking by banks and borrowers which helped both spur on the crisis, extend the crisis, and provide a landing pad by way of a stimulus following the crisis.

Also, the housing bubble itself contributed along with the real estate industry as the ever-inflating home values allowed people to take out second mortgages as long as the value of their asset was going up. In turn, the new mortgages created more products for banks to sell. They also ensured more defaults when the bubble burst.

Ron Paul Predicted Housing Bubble, Worst US Financial Crisis of 2008 IN 2003. Ron Paul and others predicted the crisis, but to be fair, Ron Paul has consistently preached the same message (so he didn’t suddenly catch on to it, he instead has consistently warned against government intervention and central banking).What are “swaps and derivatives?” Derivatives are securities with prices dependent on one or multiple underlying assets (they derive their value from the performance of the underlying entity). For instance, Common derivatives include forward contracts, futures contracts, options, and swaps (an agreement between two parties to exchange sequences of cash flows for a set period of time). Specifically, collateralized debt obligations including Synthetic CDOs and credit default swaps are types of derivatives, and credit default swaps are “swaps”. It’s all jargon for insurance-like products sold by banks that allow people to speculate on products like mortgages. Learn more at investopedia.com.[10][11]

What Popped the Bubble?

The housing bubble’s causes and effects are many, but the bubble was popped by one specific event.

By 2006 over 20% of mortgages were subprime, and about 80% of subprime mortgages were adjustable-rate mortgages set to change their rates in mid-2007 after the housing bubble popped, but before the overall banking bubble popped causing the crisis and recession.[12]

When the rates changed, many of those living in homes for next to nothing due to taking NINA “No Income No Asset” loans, defaulted. The banks were left with so many “troubled assets” that the multi-trillion dollar market collapsed leaving everyone selling off assets like CDOs for pennies on the dollar, which was their actual value.

Global Financial Meltdown – One Of The Best Financial Crisis Documentary Films. Watch this.Where Did the Money Go?

When the wealth was lost, it had to come from somewhere, and it came from two places:

- From depreciation of the value of all the assets that were overvalued (meaning financial products and real estate products). This means 401ks, pensions, homes, etc.

- The American taxpayer who bailed out the banks. This means it got put on the U.S. credit card with interest, although it should be noted this is a global crisis so many nations did this.

Another important effect is that central banks have since lowered interests rates to stimulate the economy, today there are even negative interests rates!

TIP: Below are a series of videos from PBS CrashCourse which explain not only economics and policy but the ins-and-outs of the financial crisis. The good thing is that they aren’t biased like many others who have strong opinions about the crash, banks, and economic policy (both from Congress, the executive, and the FED).

Inflation and Bubbles and Tulips: Crash Course Economics #7 Fiscal Policy and Stimulus: Crash Course Economics #8 What’s all the Yellen About? Monetary Policy and the Federal Reserve: Crash Course Economics #10 Recession, Hyperinflation, and Stagflation: Crash Course Econ #13Who is Right? What did We Do? What Should We Have Done?

First, we didn’t do much, but we did something.

Almost no one went to jail, the big banks weren’t broken up, people lost their homes, pensions, and savings, and the bankers were bailed out by the taxpayer (TARP), interest rates were lowered, etc.

This is frustrating, but it wasn’t necessarily the wrong move, especially when you consider the gentler regulation that has been done since, like Dodd-Frank.

The market is now balanced out somewhat.People refinanced keeping property artificially high and some money coming in and there is more regulation now, especially on the lending side. The tranche products are still for sale and Glass–Steagall is still repealed.

The main problem is, all of this is confusing. Let’s be honest, most people would rather watch Dancing with the Stars then research synthetic CDOs and negative interest rates and who can blame them?

A few smart people saw it coming. Some even “shorted” the market before 2008, ironically making some of the billions the banks and taxpayer lost. Most people are focused on the here and now. Is the market going up? Can I get a nice house and low interests rates?

Our enemy is not just the corruption of bankers, real estate agents, politicians, or poor people taking loans. Our enemy is a general lack of education, discussion, and, oddly enough, self-interest, which despite Adam Smith’s best intentions it seems we don’t fully yet understand.

Luckily, for those who don’t want to dwell on problems, they made a rather enjoyable Hollywood movie on the crisis!

THE BIG SHORT MOVIE EXPLAINED ANIMIATED. The best way to understand the Crisis may be to watch the movie. While making money is fun, the nerdy details may get BORING (see “why no one noticed the bubble”). This video explains the movie “the Big Short.” I suggest you watch it, it’s currently on Netflix. The Big Short Trailer (2015) ‐ Paramount Pictures.Predicting the Next Bubble, the Next Burst, and the Next Financial Crisis

Every era is a new era. Today there are new bubbles. Some are local, some are global; some are related to debt; some are not. While basic physics says a bubble filled with hot air must burst, nothing says when or what the consequences will be. No one knows what the right bet to take on the next occasion will be. Furthermore, if we listen to past thinkers like Minsky, and have the proper regulation in place, we can potentially avoid a pop all together!

We live in a new age. We have a modern global economy and many private and public forces that could either stave off or expedite a crisis. We no longer rely on a gold standard, and while not every lesson that should have been learned was learned, some were.

One thing to remember is that there is no single canary in the coal mine; there are many signs to pay attention to. Only in a completely uncorrupted system does a cause have a direct effect. The days of Jefferson’s strict non-interventionism are long over. Not even mortgages defaults mid-2007 caused a crash immediately. ENRON higher-ups and investors had an absurdly lengthy window of time to strap on a parachute and waltz out of the burning building.

Libertarian-minded figures like Ron Paul (featured in the video above) and Peter Schiff have been preaching against central banks, and for gold their whole careers. So, while figures like John Paulson saw valid warning signs and made a fortune predicting the last crisis, those who always cry “the sky is falling, buy gold” like Paul and Schiff (despite being equally as right) should be taken with a grain of salt.

Be educated and wary. Don’t be overly optimistic based on commissions, securities ratings, or too-good-to-be-true loans. Do pay attention to local politics and partake in civil service to offset the half-breeds and cronies. Diversify your investments. There is also wisdom in not betting against America and not living your life in a negative panic.

Despite the DotCom and housing bubbles, one would have still made a good amount of money dollar cost averaging in the S&P, and thus would have profited off supporting America’s companies and doing something positive to help ensure our collective future. When everyone gets greedy, and people put too many eggs in one basket, the world suffers, greed is sometimes good in the short term, but investing in real American values via a diverse portfolio is a better long term strategy.

Overdose: The Next Financial Crisis. This documentary describes how the financial crisis and corresponding stimulus created stability, but has also led to global bubbles, negative interests rates, and more. Learn more about the everything bubble (we are hopefully not in, but might very well be.- The Great Recession of 2007–09

- 2007-09 Financial Crisis

- Great Recession

- The Financial Crisis Explained

- The origins of the financial crisis Crash course

- Federal Reserve Timeline of Crisis

- Financial crisis – The Guardian

- Financial Crisis for Beginners

- ELI5: What caused the financial crisis in 2008?

- What is the difference between derivatives and swaps?

- An Introduction To Swaps

- THE ST TE OF THE A NATION’S HOUSING 2008